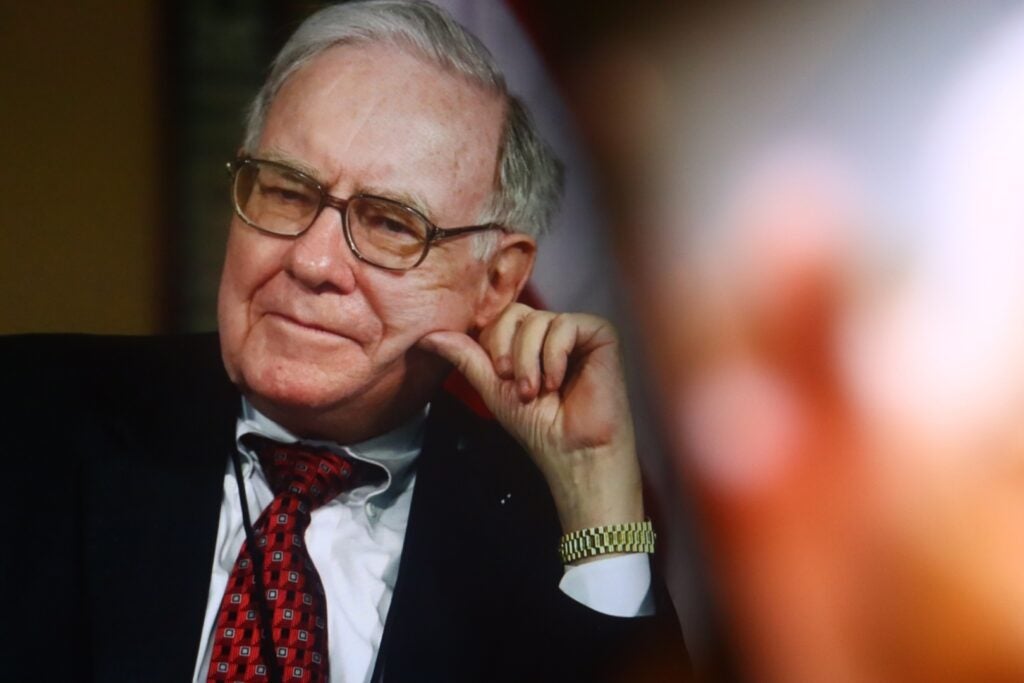

Warren Buffett’s Surprising Admission: Tim Cook Outshines His Investment Legacy

In a rare moment of humility, legendary investor Warren Buffett acknowledged that Apple CEO Tim Cook has surpassed his own financial achievements by significantly boosting Berkshire Hathaway’s earnings through Apple’s stock performance. The 93-year-old billionaire made these remarks during a recent shareholder meeting, praising Cook’s leadership and innovation in the tech sector. This unexpected admission has sparked discussions about shifting investment paradigms and the growing dominance of technology in global markets.

The Oracle of Omaha Meets His Match

Buffett, often called the “Oracle of Omaha” for his investment prowess, revealed that Berkshire’s Apple holdings—acquired primarily between 2016 and 2018—have grown to represent nearly 50% of the conglomerate’s massive equity portfolio. As of Q2 2023, Berkshire owns over 915 million Apple shares worth approximately $170 billion, making it the company’s largest public stock holding.

“Tim Cook has done a phenomenal job managing Apple,” Buffett stated. “What he’s accomplished makes some of my best investments look ordinary by comparison.” This praise carries significant weight coming from an investor whose $1,000 stake in Berkshire in 1964 would be worth over $10 million today.

Quantifying Cook’s Impact on Berkshire

The numbers tell a compelling story:

- Apple’s market capitalization grew from $600 billion to over $3 trillion under Cook’s leadership

- Berkshire’s initial $36 billion investment in Apple has nearly quintupled in value

- Apple contributes approximately $800 million annually to Berkshire in dividends alone

Financial analyst Rebecca Chen of Morningstar notes: “This represents a seismic shift in Berkshire’s portfolio composition. Technology now accounts for nearly half their holdings, compared to just 3% a decade ago. Cook’s execution has forced even value investors to rethink their strategies.”

Leadership Styles: Contrasting Philosophies

While Buffett built his reputation through careful value investing in traditional industries, Cook has demonstrated how operational excellence in tech can create unprecedented shareholder value. The two leaders represent different generations and approaches:

- Buffett: Long-term holding, margin of safety, “moat” businesses

- Cook: Supply chain mastery, ecosystem development, premium branding

Harvard Business School professor James Wilcox observes: “What makes this relationship fascinating is how Cook’s operational genius complements Buffett’s capital allocation skills. It’s not that one approach is better—they’ve created extraordinary synergies.”

Market Implications of Buffett’s Admission

Buffett’s comments arrive at a pivotal moment for investors. The S&P 500’s performance has become increasingly concentrated in technology stocks, with Apple, Microsoft, and other tech giants driving a disproportionate share of gains. Some market watchers see potential risks in this concentration.

“While Apple’s success under Cook is undeniable,” warns Morgan Stanley strategist David Cheng, “investors should remember that no single company can defy gravity forever. Diversification remains a fundamental principle.”

Nevertheless, Apple continues to demonstrate remarkable resilience. Even during 2022’s tech downturn, the company outperformed peers, with services revenue growing 14% year-over-year to $78 billion—a testament to Cook’s strategic pivot toward recurring revenue streams.

The Future of Berkshire’s Tech Bet

Looking ahead, analysts speculate whether Berkshire will maintain its massive Apple position or begin diversifying. The conglomerate recently trimmed its stake by 1%, though Buffett characterized this as routine portfolio management rather than a change in outlook.

Key considerations for Berkshire’s future moves include:

- Apple’s ability to innovate beyond the iPhone

- Regulatory challenges in multiple jurisdictions

- Valuation metrics compared to historical norms

- Succession planning at both Apple and Berkshire

As tech continues reshaping global markets, Buffett’s surprising admission may signal broader changes in investment philosophy. For now, the partnership between Berkshire and Apple stands as one of the most successful investor-CEO collaborations in modern finance.

What Investors Can Learn From This Relationship

This unusual case study offers several key takeaways:

- Even legendary investors recognize when others outperform their methods

- Operational excellence can create value beyond financial engineering

- Successful investing requires adapting to technological disruption

- The best partnerships combine complementary strengths

As the investment landscape evolves, Buffett’s candor about Cook’s achievements serves as both a tribute and a challenge to conventional wisdom. For those tracking these market leaders, the next chapter promises to be equally revealing. Follow our business section for ongoing analysis of this developing story and its implications for your investment strategy.

See more Business Focus Insider Team