Warren Buffett’s Surprise Exit: What It Means for Berkshire Hathaway’s Future

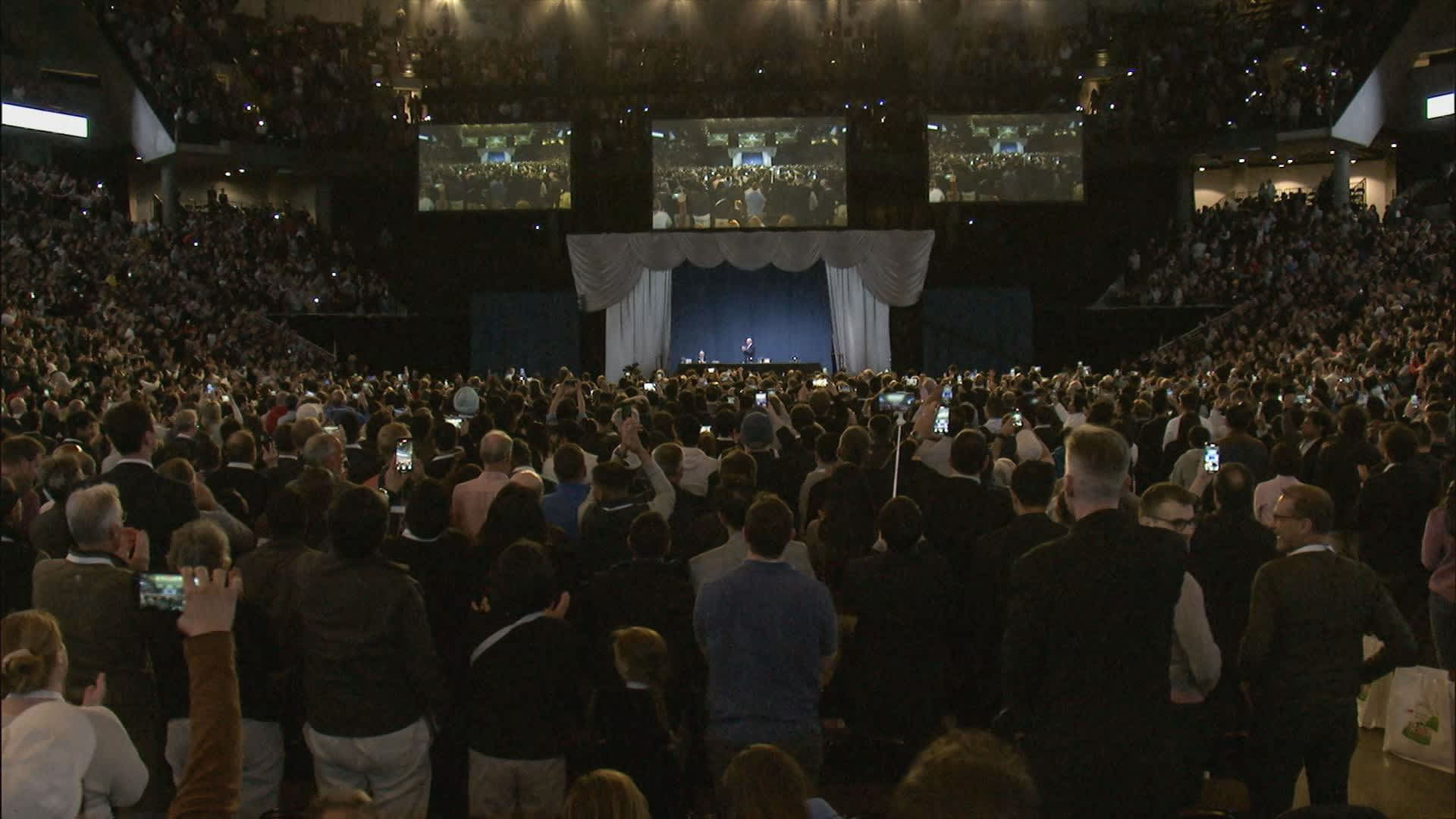

In a move that sent shockwaves through the financial world, 93-year-old Warren Buffett announced his immediate resignation as CEO of Berkshire Hathaway on Monday, ending his 60-year reign at the conglomerate. The unexpected leadership change at the Omaha-based company raises critical questions about succession planning, investment strategy, and shareholder confidence for the $880 billion holding company.

The End of an Era for Berkshire Hathaway

Buffett’s departure marks the conclusion of the most successful investing career in modern history. Since taking control in 1965, he transformed a struggling textile manufacturer into a sprawling empire encompassing:

- Insurance giants (GEICO, General Re)

- Railroads (BNSF)

- Energy companies (Berkshire Hathaway Energy)

- Consumer brands (Dairy Queen, Duracell)

- Major equity positions (Apple, Bank of America, Coca-Cola)

“This isn’t just a CEO transition—it’s the passing of the torch from the greatest capital allocator of our time,” said financial historian Margaret Atwater of Columbia Business School. “Buffett’s annual letters became required reading for generations of investors. His absence creates both practical and psychological challenges for Berkshire.”

Succession Plan Put to the Test

The board immediately named Greg Abel, 61, as Berkshire’s new CEO, activating a succession plan first hinted at in 2021 when Abel was promoted to Vice Chairman. Abel previously led Berkshire Hathaway Energy and the non-insurance operations, earning Buffett’s praise for his “capital discipline and operational excellence.”

Key facts about the leadership transition:

- Abel becomes only the 4th CEO in Berkshire’s history

- Investment managers Todd Combs and Ted Weschler will oversee the $350 billion portfolio

- Buffett remains as Chairman but will no longer make daily decisions

Market reaction was muted initially, with Berkshire’s Class A shares dipping just 1.2% on the news. “The smooth transition suggests investors have confidence in Abel,” noted Goldman Sachs analyst James Reynolds. “But the real test comes when he faces his first major crisis or acquisition decision without Buffett’s counsel.”

Potential Shifts in Investment Strategy

Analysts anticipate several possible changes under Abel’s leadership:

- Increased technology investments: Abel spearheaded Berkshire’s 2017 stake in Pilot Travel Centers, demonstrating comfort with tech-enabled businesses

- More aggressive capital deployment: With $167 billion in cash reserves, pressure mounts to put money to work

- Possible share buybacks: Abel may accelerate repurchases if opportunities remain scarce

However, Berkshire veteran Munger Johnson cautions against expecting radical changes: “The culture Buffett built runs deep. Abel won’t abandon the core principles of value investing, but he’ll inevitably put his own stamp on things.”

Challenges Facing the New Leadership

Abel inherits several immediate challenges:

- Managing Berkshire’s enormous cash position in a high-interest rate environment

- Maintaining the company’s unique decentralized structure across 80+ subsidiaries

- Preserving the “Berkshire premium” that makes acquired companies accept lower prices

- Navigating increasing regulatory scrutiny of large conglomerates

The transition comes at a delicate time for Berkshire’s insurance operations, which contributed 32% of 2023 operating earnings. Climate change-induced disasters have increased claims, while competitive pressures squeeze margins.

Berkshire’s diverse shareholder base shows mixed reactions:

- Retail investors: Many express sentimental attachment to Buffett personally

- Institutional holders: Generally approve the orderly transition process

- Activists: May push for changes like dividend payments or spinoffs

Notably, Berkshire’s stock has outperformed the S&P 500 by 120% over the past 20 years, creating immense pressure to maintain that track record. “The cult of personality around Buffett provided cover during rough patches,” notes hedge fund manager Lisa Yang. “Abel won’t have that luxury—every decision will be scrutinized.”

The Future of Berkshire Without Buffett

Looking ahead, experts identify three critical areas to watch:

- Cultural continuity: Whether Abel can maintain Berkshire’s unique partnership culture

- Deal flow: If private companies will still prefer Berkshire buyers without Buffett’s involvement

- Talent retention: Keeping key managers at subsidiaries who came specifically to work with Buffett

As the financial world digests this seismic shift, one thing remains certain: Warren Buffett’s legacy as the “Oracle of Omaha” is secure. But the next chapter of Berkshire Hathaway’s story begins today under very different leadership. Investors would be wise to monitor upcoming quarterly reports and Abel’s first annual letter for clues about the company’s evolving direction.

For deeper analysis of how this leadership change may affect your Berkshire Hathaway holdings, consult with a financial advisor to review your portfolio strategy.

See more Business Focus Insider Team