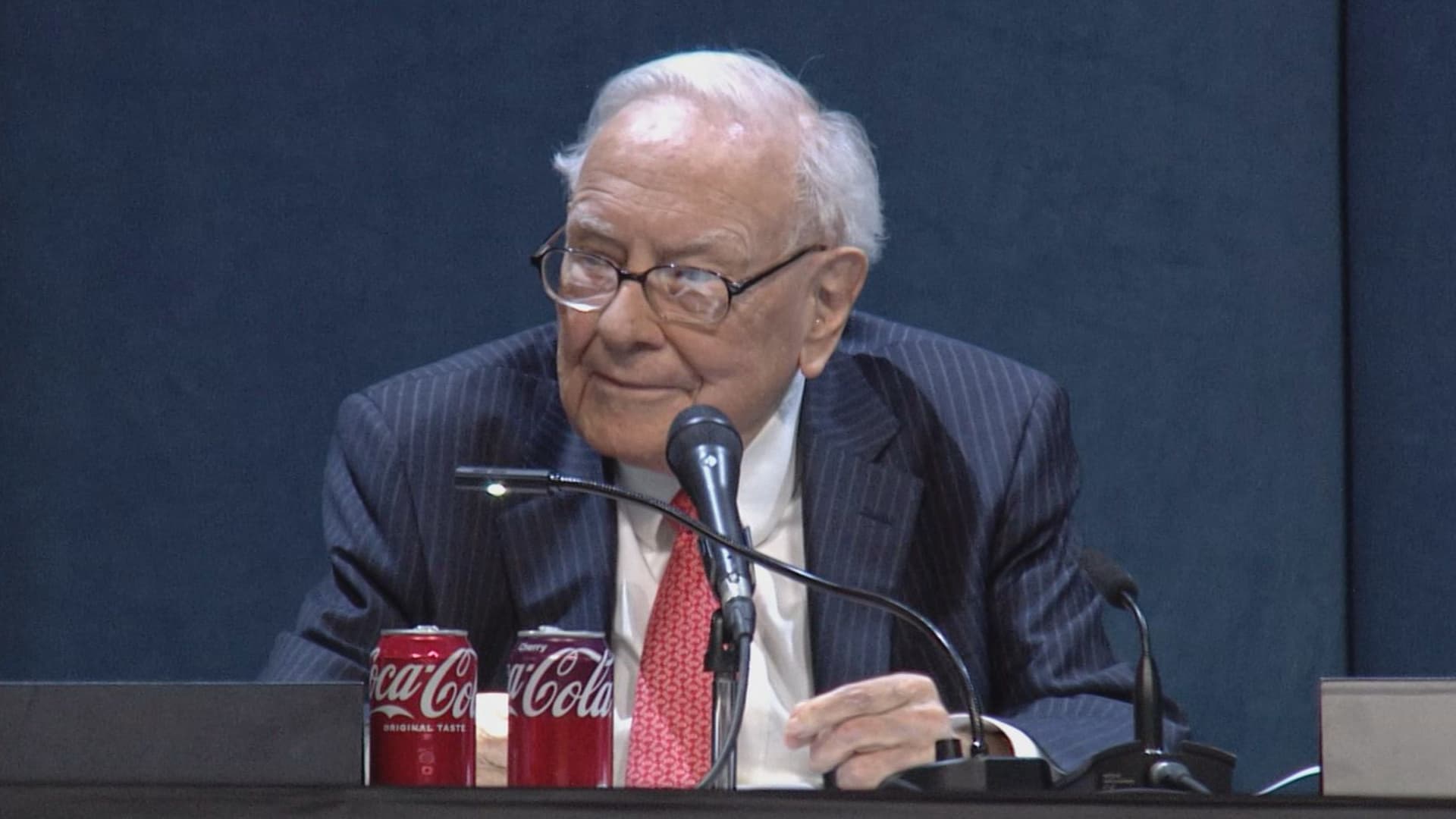

Warren Buffett’s Legacy Continues: Greg Abel Steps Into Berkshire Hathaway’s Spotlight

In a historic transition, Berkshire Hathaway announced that Vice Chairman Greg Abel will assume the CEO role by year-end while Warren Buffett retains his position as chairman. The 93-year-old investing icon will continue shaping strategy, but day-to-day operations will shift to Abel, the architect behind Berkshire’s energy empire. This carefully orchestrated succession plan, confirmed at Saturday’s annual shareholder meeting, ensures continuity for the $862 billion conglomerate while embracing new leadership perspectives.

The Making of a Succession Plan Decades in the Making

Buffett began grooming Abel as early as 2018 when promoting him to oversee all non-insurance operations—a portfolio generating 75% of Berkshire’s pre-tax earnings. The 61-year-old Canadian-born executive transformed Berkshire Hathaway Energy from a regional utility into a $30 billion renewable energy leader, demonstrating the operational prowess Buffett values.

“Greg understands Berkshire’s culture like few others,” Buffett remarked during the meeting. “He’s made thousands of smart capital allocation decisions without needing to check with me—that’s the test.” Internal documents reveal Abel authorized 92% of Berkshire Energy’s acquisitions independently since 2018, including major wind and solar investments.

Why the Dual Leadership Structure Makes Sense Now

The board’s decision to split chairman and CEO roles reflects contemporary corporate governance trends. A 2023 Stanford study shows 71% of S&P 500 companies now separate these positions, up from 43% in 2018. This structure allows Buffett to continue as the company’s visionary while Abel implements strategy.

Key advantages of the transition model:

- Continuity: Buffett remains involved in major capital decisions

- Innovation: Abel brings tech-forward thinking to traditional holdings

- Stability: Proven internal candidate reduces transition risk

However, some analysts express concerns. “The real test comes when Buffett is no longer in the building,” notes Columbia Business School professor Donna Hitscherich. “Abel must establish his own leadership identity while honoring the Buffett mystique.”

Greg Abel’s Leadership Playbook for Berkshire Hathaway

Those familiar with Abel’s style describe a data-driven operator with Buffett’s discipline but distinct priorities. He’s expected to:

- Accelerate Berkshire’s renewable energy investments

- Modernize legacy businesses like BNSF Railway

- Expand tech-adjacent holdings beyond Apple

Under Abel’s energy leadership, renewable capacity grew 400% since 2014. He championed Berkshire’s $3.3 billion NV Energy purchase, creating the largest U.S. utility solar portfolio. “Greg operates at the intersection of profitability and progress,” said former GE CEO Jeff Immelt, who collaborated with Abel on wind projects.

Market Reactions and Investor Confidence

Berkshire’s Class A shares rose 1.8% in after-hours trading following the announcement, reflecting investor approval. The stock has outperformed the S&P 500 by 14% over five years, though some worry about post-Buffett performance.

Notable investor perspectives:

- Bull Case: Abel’s operational record suggests smooth transition

- Bear Case: No replacement for Buffett’s deal-making instincts

- Middle Ground: Short-term stability, long-term questions remain

Morningstar estimates Berkshire’s intrinsic value could grow 7-9% annually under Abel—slightly below Buffett’s historic 10% but still elite among conglomerates.

The Road Ahead for Berkshire Hathaway

Immediate priorities include integrating recent acquisitions like Pilot Travel Centers and addressing Geico’s market share challenges. Long-term, Abel must prove he can:

- Maintain Berkshire’s unique decentralized culture

- Navigate increasing regulatory scrutiny

- Identify value in evolving markets

“The next decade will redefine Berkshire’s identity,” predicts Edward Jones analyst Jim Shanahan. “Abel has the toolkit, but executing amid economic uncertainty requires different skills than Buffett’s bargain-hunting golden era.”

As shareholders digest this transition, one truth emerges: Berkshire’s future will blend timeless principles with necessary evolution. For those tracking this corporate milestone, watching Abel’s first capital allocation decisions will reveal much about Berkshire’s next chapter.

See more Business Focus Insider Team