Uber’s Revenue Shortfall: Why 18% Trip Growth Didn’t Translate to Profits

Uber Technologies Inc. reported an 18% year-over-year increase in global trips during its latest quarterly earnings, yet stunned investors with disappointing revenue results. The ride-hailing giant’s financial update, released this week, revealed stagnant revenue growth despite surging demand, sparking analyst concerns about pricing pressures, competitive markets, and operational costs. The disconnect between trip volume and financial performance suggests deeper challenges in Uber’s business model as it navigates post-pandemic recovery.

The Numbers Behind the Paradox

Uber’s Q2 report showed 2.3 billion completed trips globally, up from 1.9 billion in the same period last year. However, revenue only reached $9.23 billion—falling short of Wall Street’s $9.33 billion projection. This represents merely a 14% revenue increase compared to the 18% trip growth, indicating declining average revenue per trip. Key data points include:

- Mobility (ride-hailing) revenue growth slowed to 38% year-over-year, down from 72% in Q1

- Delivery segment revenue increased just 6% despite 14% more orders

- Operating expenses rose 22%, outpacing revenue growth

“This isn’t just a blip—it’s a troubling trend,” noted transportation economist Dr. Lisa Chen of Stanford University. “When your unit economics deteriorate while demand increases, it suggests systemic issues in pricing power or cost structure.”

Market Forces Squeezing Uber’s Margins

Industry analysts point to three primary factors undermining Uber’s revenue potential despite growing demand:

1. Price Sensitivity: Consumers have become increasingly resistant to surge pricing, with 68% of riders reportedly waiting for fares to normalize according to a recent Edison Trends study. “People now treat Uber as a discretionary service,” observed retail analyst Michael Tanaka. “They’ll take the subway or wait rather than pay premium prices.”

2. Driver Incentives: Uber continues spending heavily to maintain its driver base, with incentives and guarantees consuming 12% of gross bookings—up from 9% last year. “The labor market remains tight, and drivers have more platform choices than ever,” explained labor economist Priya Malhotra.

3. Regulatory Pressures: Several major markets including New York, London, and California have implemented new driver compensation rules that increase Uber’s operational costs. The company estimates these regulations have added $300 million in annual expenses.

Competitive Landscape Intensifies

Uber faces mounting competition on multiple fronts:

- Traditional taxi companies adopting app-based hailing

- Regional players like Lyft and Didi undercutting prices

- Delivery rivals DoorDash and GrubHub offering lower commission rates

“We’re seeing a classic commoditization of ride-hailing services,” said tech analyst Raj Patel. “When consumers see little difference between providers, price becomes the deciding factor—and that erodes margins industry-wide.”

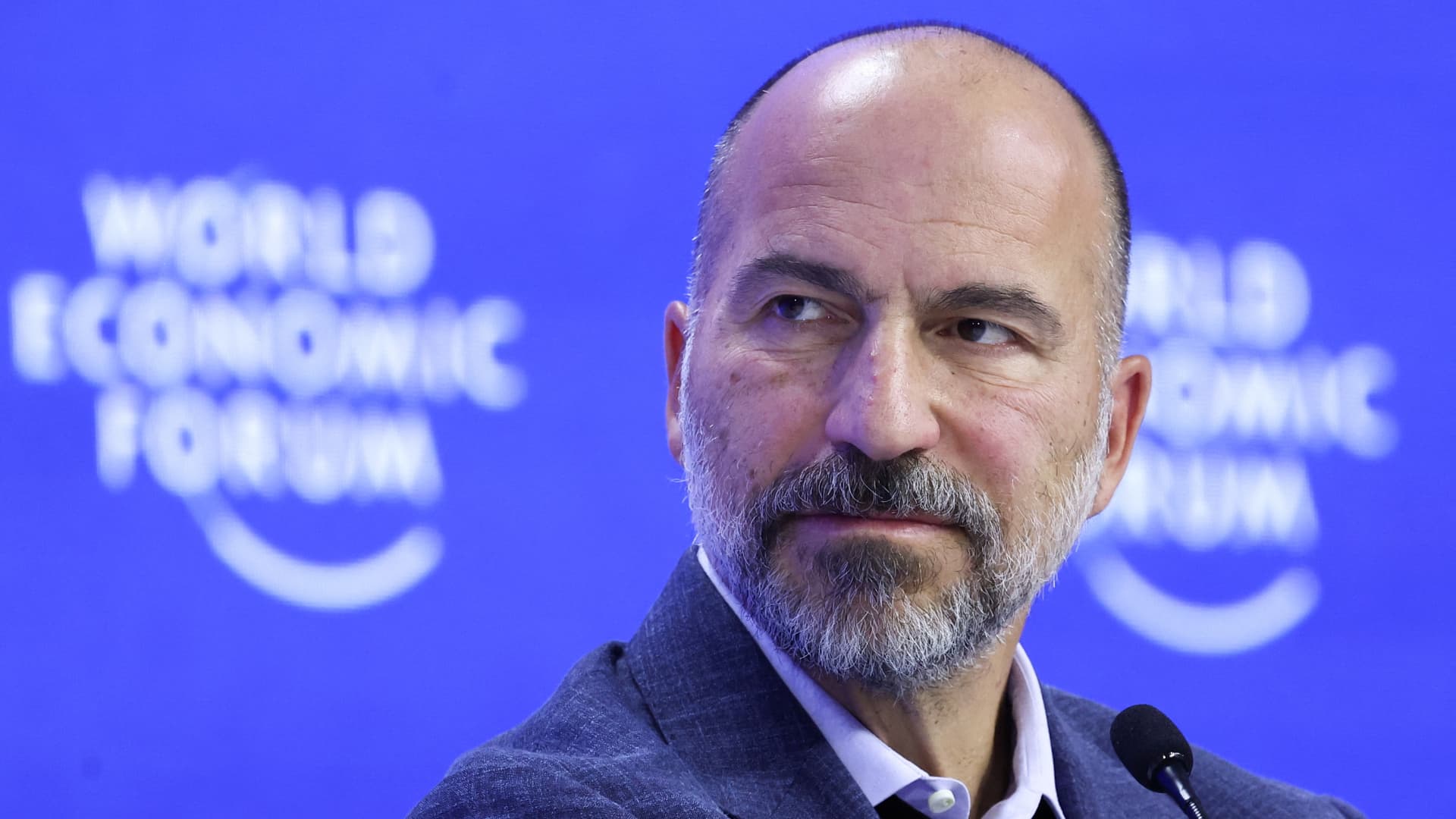

Uber CEO Dara Khosrowshahi acknowledged these challenges in the earnings call: “While we’re pleased with our growth in engagement, we recognize the need to improve monetization efficiency across our platform. Our focus remains on balanced growth and sustainable unit economics.”

Investor Reactions and Stock Impact

The market responded swiftly to Uber’s report, with shares dropping 7.3% in after-hours trading. Several analysts downgraded their price targets:

- Morgan Stanley cut from $50 to $45

- Goldman Sachs revised from $52 to $48

- Barclays maintained Equal Weight but lowered estimates

“The valuation assumed Uber could maintain premium pricing as the market leader,” explained Wells Fargo analyst Brian Fitzgerald. “These results suggest that assumption may need revisiting.”

Strategic Shifts on the Horizon

Uber appears poised to make several adjustments to address its revenue challenges:

1. Subscription Push: The company is aggressively marketing its Uber One membership program, which offers discounts for a monthly fee. Subscriptions grew 40% year-over-year to 12 million members.

2. Advertising Expansion: Uber plans to triple its advertising business by 2025, leveraging its app real estate and customer data. Ad revenue already reached $650 million last year.

3. Cost Controls: Executives hinted at “operational efficiency initiatives” including reduced hiring and marketing spend optimization.

The Road Ahead for Uber

Industry observers remain divided on Uber’s long-term prospects. Bullish analysts emphasize the company’s scale advantage and potential for automation. Bears warn of structural profitability challenges in the ride-hailing sector.

“Uber’s fundamental dilemma is that it needs to keep prices low enough to maintain demand but high enough to cover rising costs,” summarized Dr. Chen. “Walking that tightrope becomes increasingly difficult as markets mature.”

The company’s next moves will likely determine whether it can translate its massive user base into sustainable profits. Investors and industry watchers alike will scrutinize Uber’s Q3 performance for signs of improvement in its revenue-per-trip metrics.

For consumers, the silver lining may be continued competitive pricing in the near term. Those interested in tracking Uber’s financial turnaround can subscribe to earnings alerts through major financial platforms.

See more Business Focus Insider Team