Trump and Tim Cook: A Strategic Dialogue Post-China Tariff Suspension

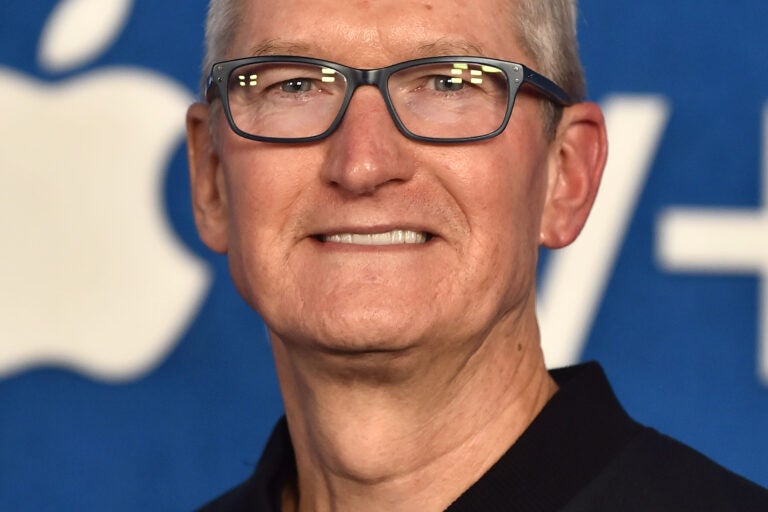

In a revealing discussion that could reshape tech-industry dynamics, former President Donald Trump disclosed details of his recent conversation with Apple CEO Tim Cook, following the Biden administration’s suspension of tariffs on Chinese imports. The dialogue, which occurred last week, centered on supply chain resilience, U.S. manufacturing, and the economic implications of shifting trade policies. Analysts suggest this exchange may signal Apple’s strategic maneuvering amid geopolitical tensions.

The Context: Tariff Suspension and Tech Industry Implications

The Biden administration’s June 2024 decision to suspend certain tariffs on Chinese goods—including electronics components—has sent ripples through global markets. According to U.S. Trade Representative data, the suspended tariffs cover approximately $34 billion worth of imports, with tech products accounting for 42% of affected items. This move temporarily eases pressure on companies like Apple, which relies heavily on Chinese manufacturing.

“The tariff suspension creates breathing room, but it’s a temporary Band-Aid,” says Dr. Evelyn Chen, a trade policy expert at the Brookings Institution. “Tech giants must still navigate long-term uncertainties around U.S.-China relations.” Indeed, Apple’s supply chain remains vulnerable, with 95% of iPhones still assembled in China as of Q1 2024, per Counterpoint Research.

Key Takeaways from the Trump-Cook Exchange

Trump’s account of the conversation highlights three critical themes:

- Domestic Manufacturing Push: Trump reportedly urged Cook to accelerate Apple’s investments in U.S. production facilities. The company has pledged $430 billion in domestic investments through 2026 but faces logistical hurdles.

- Supply Chain Diversification: Both leaders acknowledged the need to reduce reliance on China, with Cook noting Apple’s growing operations in India and Vietnam.

- Policy Predictability: Cook emphasized the importance of stable trade policies for long-term planning—a subtle nod to the whiplash effect of shifting tariff regimes.

“When you’re dealing with supply chains that span continents, consistency matters more than short-term relief,” remarked tech analyst Mark Zohar of Forrester Research. “Apple’s 2023 experience with Shanghai lockdowns proved how quickly disruptions can cascade.”

The Broader Economic Landscape

This dialogue occurs against a backdrop of escalating tech competition between the U.S. and China. Recent Commerce Department restrictions on advanced semiconductor exports have further complicated matters. Meanwhile, Apple’s Q2 2024 earnings revealed a 12% year-over-year increase in services revenue—a bright spot as hardware sales face headwinds.

Not all observers view the Trump-Cook exchange as productive. “This is political theater masking deeper structural issues,” argues Li Wei, director of the Asia-Pacific Trade Initiative. “No single conversation can resolve the fundamental tensions between globalization and national security priorities.”

Future Scenarios for Apple and U.S. Tech Policy

Industry watchers outline several potential outcomes:

- Accelerated Diversification: Apple may fast-track plans to move 25% of iPhone production to India by 2025 (up from current 7%).

- Policy Lobbying: Cook could leverage this dialogue to advocate for tech-specific trade provisions in future legislation.

- Election-Year Calculations: With tariffs likely to resurface as a campaign issue, tech firms are preparing contingency plans.

As the 2024 election cycle intensifies, such high-profile exchanges between business and political leaders will likely multiply. For now, Apple remains cautiously optimistic. “We’re committed to building the best products while navigating complex realities,” a company spokesperson told Reuters this week.

What Comes Next?

The temporary tariff suspension expires in November 2024, coinciding with the U.S. presidential election. Whether this marks a turning point or mere intermission in the U.S.-China tech cold war depends on three factors: election outcomes, China’s response to U.S. chip restrictions, and Apple’s ability to execute its diversification strategy.

For investors and policymakers alike, the Trump-Cook conversation serves as a reminder: In today’s fragmented global economy, even temporary respirates warrant strategic reassessment. Those seeking deeper analysis can access our exclusive report on emerging supply chain models in the tech sector.

See more Business Focus Insider Team