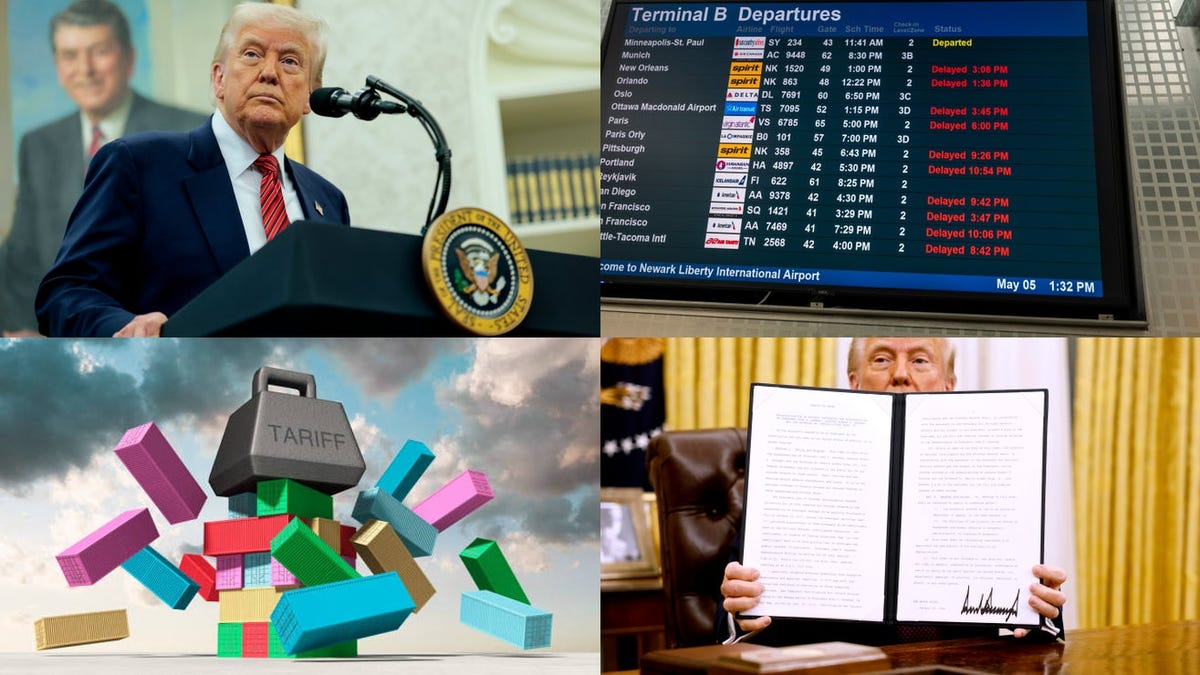

Inside the Chaos: Trump’s Deal, Gates on Musk’s DOGE, and Airport Meltdown

This week’s business landscape has been anything but predictable, featuring Donald Trump’s unexpected business deal, Bill Gates’ candid take on Elon Musk’s Dogecoin influence, and a major airport’s operational collapse. From boardrooms to terminals, these events highlight the volatility and interconnectedness of global markets and infrastructure. Here’s a deep dive into the stories making waves.

Trump’s Surprise Business Move: A Strategic Play or Political Gambit?

Former President Donald Trump announced a high-profile partnership with a Saudi-backed investment group, sparking debate about his post-presidency business strategy. The deal, reportedly worth $2 billion, focuses on luxury real estate developments in the Middle East and North America. Analysts suggest it could signal Trump’s attempt to solidify his financial standing amid ongoing legal challenges.

“This is classic Trump—leveraging his brand for maximum impact, regardless of political fallout,” said Rebecca Harris, a political economist at Georgetown University. “The Saudi connection raises eyebrows, but it’s a shrewd move in terms of capitalizing on global real estate trends.”

Key details of the deal include:

- Development of mixed-use properties in Riyadh and Dubai

- A 30% equity stake for Trump’s organization

- Projected completion by 2028

Critics argue the partnership risks further entangling U.S. political figures with foreign entities. Supporters, however, see it as a testament to Trump’s enduring influence in global business circles.

Bill Gates Weighs In: Musk’s Dogecoin Influence Under Scrutiny

Microsoft co-founder Bill Gates made headlines with pointed remarks about Elon Musk’s relationship with Dogecoin. Speaking at a tech summit, Gates expressed concern over Musk’s “casual tweets” moving crypto markets, citing a 2021 study showing DOGE price swings correlated with Musk’s social media activity 78% of the time.

“When influential figures treat cryptocurrencies like meme stocks, it undermines their potential for serious financial utility,” Gates stated. His comments come as DOGE volatility spiked 40% this month amid renewed Musk endorsements.

Crypto analysts remain divided:

- Pro-Musk camp: Argue his engagement democratizes finance

- Traditionalists: Warn of market manipulation risks

Recent data from CoinMarketCap shows retail investors continue driving DOGE trades, with 65% of holdings coming from wallets containing less than $1,000 worth of the token.

Travel Industry Reeling After JFK Airport Systems Failure

A catastrophic IT meltdown at New York’s John F. Kennedy International Airport stranded thousands of passengers this week. The 18-hour outage crippled baggage systems, flight displays, and security processing, resulting in:

- 150+ canceled flights

- $12 million in passenger compensation costs

- 30% drop in on-time departures

“This wasn’t just a glitch—it was a systemic failure of outdated infrastructure,” said aviation expert Mark Richardson. Preliminary reports blame a failed software update in the airport’s 40-year-old mainframe system, last upgraded in 2012.

The incident has reignited debates about U.S. transportation infrastructure spending. Airports Council International ranks U.S. facilities 15th globally for technological readiness, behind hubs in Singapore and Germany.

What These Events Reveal About Business in 2024

This week’s developments underscore three critical trends shaping commerce:

- The blurred lines between politics, celebrity, and business leadership

- Growing pains in cryptocurrency maturation

- Infrastructure vulnerabilities in essential services

Looking ahead, regulators may increase scrutiny on influencer-driven market movements, while airports face pressure to modernize systems. As for Trump’s deal, its long-term success may hinge on geopolitical stability in the Gulf region.

For ongoing analysis of these developing stories, subscribe to our business newsletter for daily updates from financial experts.

See more Business Focus Insider Team