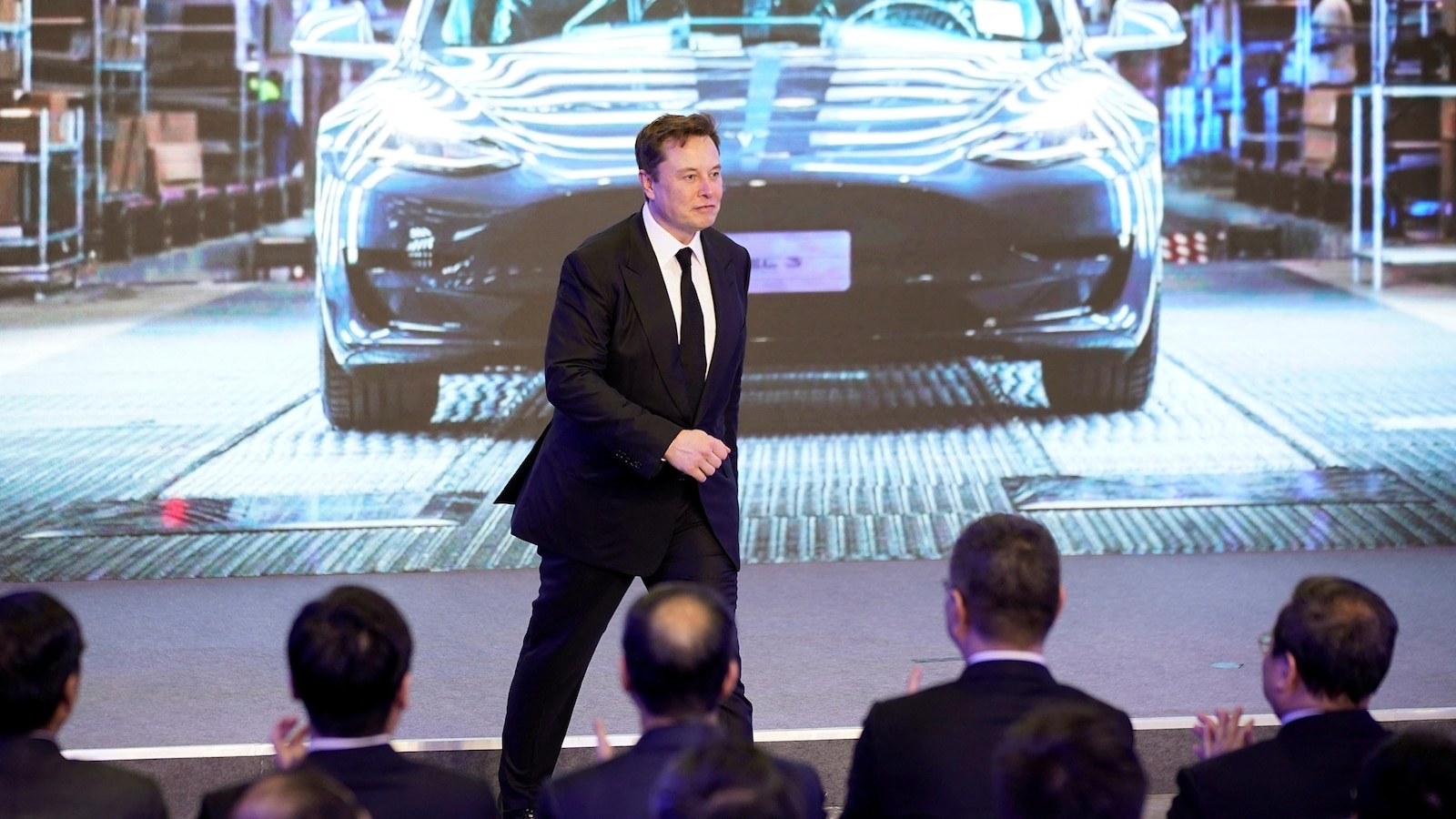

Will Tesla’s Earnings Reveal the Impact of the Anti-Musk Sentiment?

As Tesla prepares to release its quarterly earnings report this week, analysts and investors are scrutinizing whether growing public backlash against CEO Elon Musk has dented the electric vehicle (EV) giant’s financial performance. The report, due on Wednesday, will provide critical insights into Tesla’s resilience amid controversies surrounding Musk’s polarizing statements and leadership style. With Tesla’s stock already under pressure this year, the earnings could signal how much brand sentiment affects bottom-line results.

The Backlash Against Musk: A Growing Headwind?

Over the past year, Elon Musk has faced mounting criticism for his political commentary, management decisions, and public behavior. From his acquisition of Twitter (now X) to his endorsements of controversial figures, Musk’s actions have alienated some Tesla customers and investors. A 2023 Bloomberg survey found that 42% of potential EV buyers in the U.S. viewed Musk less favorably than a year earlier, with 15% stating it made them less likely to purchase a Tesla.

“There’s no question that Musk’s antics have created a headwind for Tesla,” said automotive industry analyst Rebecca Chen of Bernstein Research. “The bigger question is whether it’s a temporary PR problem or something that fundamentally erodes the brand’s premium positioning.”

Key indicators to watch in the earnings report include:

- Delivery numbers compared to production figures (potential inventory buildup)

- Profit margins in the face of recent price cuts

- Guidance on future demand, particularly in key markets like China and Europe

Financial Performance vs. Brand Perception

Despite the negative sentiment, Tesla’s operational metrics have remained relatively strong. The company delivered a record 1.8 million vehicles in 2023, up 38% year-over-year. However, aggressive price cuts have squeezed margins, with gross automotive margins falling from 28% in Q1 2022 to 18% in Q4 2023.

“Tesla is walking a tightrope,” noted financial analyst Mark Johnson of Wells Fargo. “They’re trying to maintain growth through price reductions while managing the reputational impact of Musk’s controversies. The earnings will show whether this strategy is sustainable.”

Recent data suggests mixed signals about consumer behavior:

- Tesla’s U.S. market share in EVs dropped from 79% in 2020 to 58% in 2023 as competition increased

- However, Tesla’s Model Y became the world’s best-selling vehicle in 2023, surpassing traditional gasoline cars

- Brand consideration among liberal-leaning buyers (a key EV demographic) declined 11% since 2022

Investor Sentiment and Stock Performance

Tesla’s stock (TSLA) has been volatile, reflecting both operational successes and Musk-related controversies. After peaking at over $400 in late 2021, shares have fluctuated between $150 and $300 for most of 2023. Some institutional investors have grown vocal about their concerns.

“We’ve seen several pension funds and ESG-focused investors reduce Tesla holdings not because of the car business, but due to governance concerns,” explained investment strategist Lisa Wong of BlackRock. “When the CEO becomes a lightning rod, it creates uncertainty that markets hate.”

Key financial metrics analysts will examine:

- Free cash flow position (was $2.1 billion in Q3 2023)

- Energy generation and storage segment growth

- Updates on Cybertruck production and costs

The China Factor and Global Competition

China represents Tesla’s most crucial growth market outside North America, accounting for about 25% of sales. However, intensifying competition from domestic EV makers like BYD, coupled with Musk’s perceived cozy relationship with Chinese authorities, has created complex dynamics.

“In China, Tesla benefits from government support but faces nationalist sentiment,” explained Shanghai-based auto analyst Wei Zhang. “Local brands are improving rapidly, and some consumers prefer supporting homegrown companies.”

Meanwhile, in Europe, Tesla faces:

- Stricter advertising regulations around environmental claims

- Growing consumer preference for legacy automakers’ EV models

- Potential regulatory scrutiny over Autopilot safety concerns

Looking Ahead: Tesla’s Path Forward

Beyond this quarter’s numbers, Tesla faces strategic crossroads. The company must navigate Musk’s divisive persona while maintaining technological leadership and scaling production. Upcoming challenges include:

- Launching the next-generation platform for a promised $25,000 vehicle

- Expanding Supercharger network partnerships with other automakers

- Scaling Full Self-Driving technology amid regulatory hurdles

“Tesla’s success has always been tied to Musk’s vision, but that’s becoming a double-edged sword,” observed industry veteran Mary Barrow of AutoTrends Consulting. “The earnings may show whether Tesla can decouple its operational excellence from Musk’s personal brand.”

For investors and industry watchers, the key takeaway will be whether Tesla can continue growing despite the anti-Musk sentiment—or if the CEO’s controversies have finally started impacting the bottom line. Either way, this earnings report promises to be one of Tesla’s most revealing in years.

For deeper analysis of Tesla’s market position, subscribe to our automotive industry newsletter for weekly updates on EV trends and company performance.

See more Business Focus Insider Team