Unveiling the Truth: Did Tesla Ever Consider a New CEO?

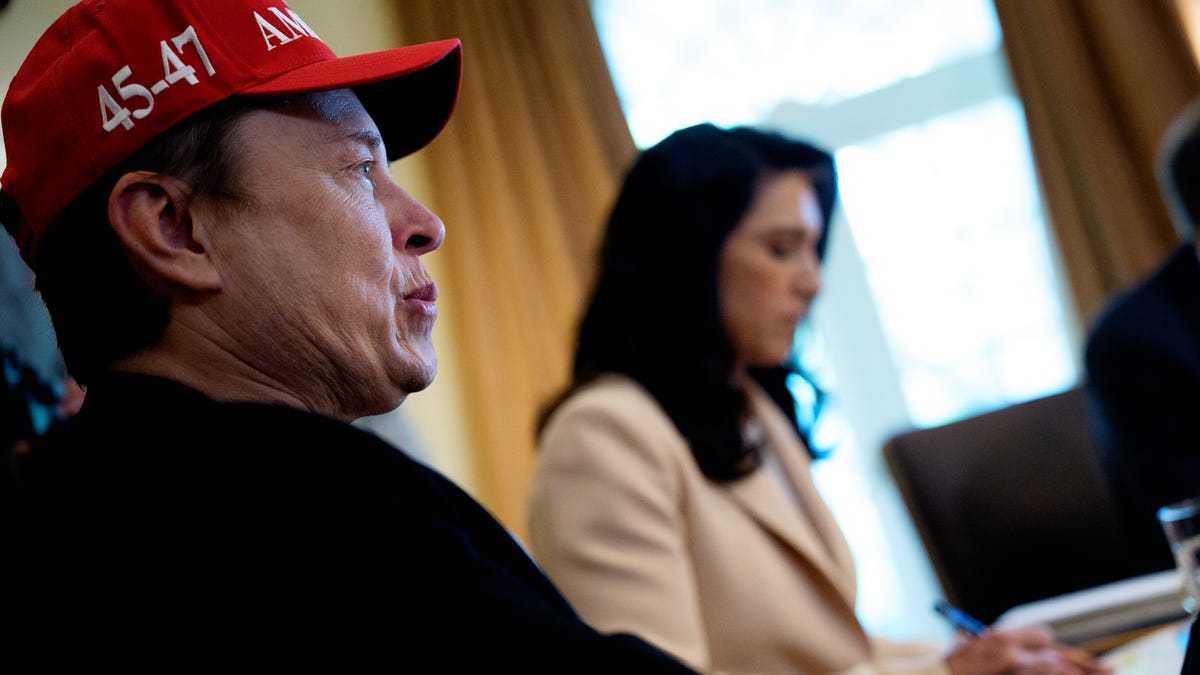

In a recent official statement, Tesla Inc. has firmly denied rumors that the electric vehicle (EV) giant considered replacing Elon Musk as CEO. The speculation, which surfaced earlier this week, sparked intense debate about leadership stability at the innovative automaker. Industry analysts suggest the rumors may reflect growing investor concerns over Musk’s divided attention across multiple ventures, including SpaceX and X (formerly Twitter).

The Genesis of the Leadership Speculation

The rumors gained traction after an unnamed source cited in The Wall Street Journal suggested Tesla’s board had discreetly explored potential CEO candidates. However, Tesla’s communications team swiftly countered these claims, labeling them “categorically false” in a terse press release. The company emphasized Musk’s “unwavering commitment” to Tesla’s mission of accelerating the world’s transition to sustainable energy.

Market reaction was immediate but mixed:

- Tesla shares dipped 2.3% following the initial rumor

- Stock partially recovered (up 1.1%) after the denial

- Trading volume surged 40% above 30-day average

Examining Musk’s Dual Role in Tesla’s Success and Challenges

Elon Musk’s leadership has been instrumental in Tesla’s meteoric rise from niche startup to $700 billion market cap automaker. Under his guidance since 2008, Tesla has:

- Pioneered mass-market EV adoption with the Model 3

- Developed industry-leading battery technology

- Built a global Supercharger network with 45,000+ connectors

However, some investors express concern about Musk’s bandwidth. “When a CEO splits focus across four major companies, it inevitably raises governance questions,” notes corporate leadership expert Dr. Sarah Chen of Stanford University. “Tesla’s board would be remiss not to periodically assess contingency plans.”

Musk himself addressed these concerns during Q2’s earnings call: “My commitment to Tesla remains absolute. The other ventures actually feed innovation back into our core mission.” Indeed, SpaceX’s materials science breakthroughs have reportedly benefited Tesla’s casting techniques.

Corporate Governance Under the Microscope

The rumors coincide with increased scrutiny of Tesla’s board composition. Currently, 5 of 8 directors have professional or personal ties to Musk dating back over 15 years. Governance watchdog The Corporate Library gives Tesla a “D” rating for board independence.

Key governance statistics:

- 33% of Tesla shareholders voted against Musk’s 2023 compensation package

- Board tenure averages 9.2 years vs. S&P 500 average of 7.1 years

- Only 1 director has automotive industry experience

Former SEC chairman Harvey Pitt weighs in: “While not illegal, such concentrated relationships can cloud objective decision-making. Periodic leadership reviews should be standard practice at all major corporations.”

How Tesla’s Leadership Compares to Industry Peers

A comparison with other automakers reveals Tesla’s unique governance structure:

| Company | CEO Tenure | Independent Directors | CEO Pay Ratio |

|---|---|---|---|

| Tesla | 15 years | 38% | 40:1 |

| Ford | 3 years | 82% | 157:1 |

| Toyota | 1 year | 75% | 93:1 |

Industry analyst Michael Zhou observes: “Traditional automakers rotate leadership more frequently, but Tesla’s innovation-driven model arguably benefits from Musk’s long-term vision.”

The Road Ahead for Tesla’s Leadership

While the CEO rumors appear unfounded, they highlight legitimate questions about Tesla’s succession planning. The company’s 2021 proxy statement mentions a “CEO succession planning process” but provides no details. In contrast, Apple had a well-documented transition plan years before Tim Cook replaced Steve Jobs.

Potential scenarios for Tesla’s leadership future:

- Status Quo: Musk remains CEO while delegating more operations

- Promotion from Within: Executives like Drew Baglino (engineering) or Zach Kirkhorn (former CFO) could step up

- External Hire: Unlikely given Tesla’s unique culture

As Tesla faces increasing competition from legacy automakers and Chinese EV brands, stable leadership becomes ever more crucial. The company aims to deliver 1.8 million vehicles in 2023 while preparing Cybertruck production and a rumored $25,000 compact model.

Why Leadership Stability Matters Now More Than Ever

With the EV market projected to grow 29% annually through 2030, Tesla’s ability to execute is paramount. The company currently holds:

- 65% of the U.S. EV market share

- 18% of the global EV market

- Industry-leading 23.8% gross margins

“Tesla is at an inflection point,” warns Morgan Stanley auto analyst Adam Jonas. “They must scale production while maintaining technological leadership. Any leadership uncertainty could jeopardize that balance.”

For investors tracking these developments, the coming quarters will be critical. Tesla’s next earnings call on October 18 may provide clearer signals about Musk’s long-term role and the board’s vision for governance.

What’s your perspective on Tesla’s leadership structure? Share your views with business editors at investorinsight@financialtimes.com.

See more Business Focus Insider Team