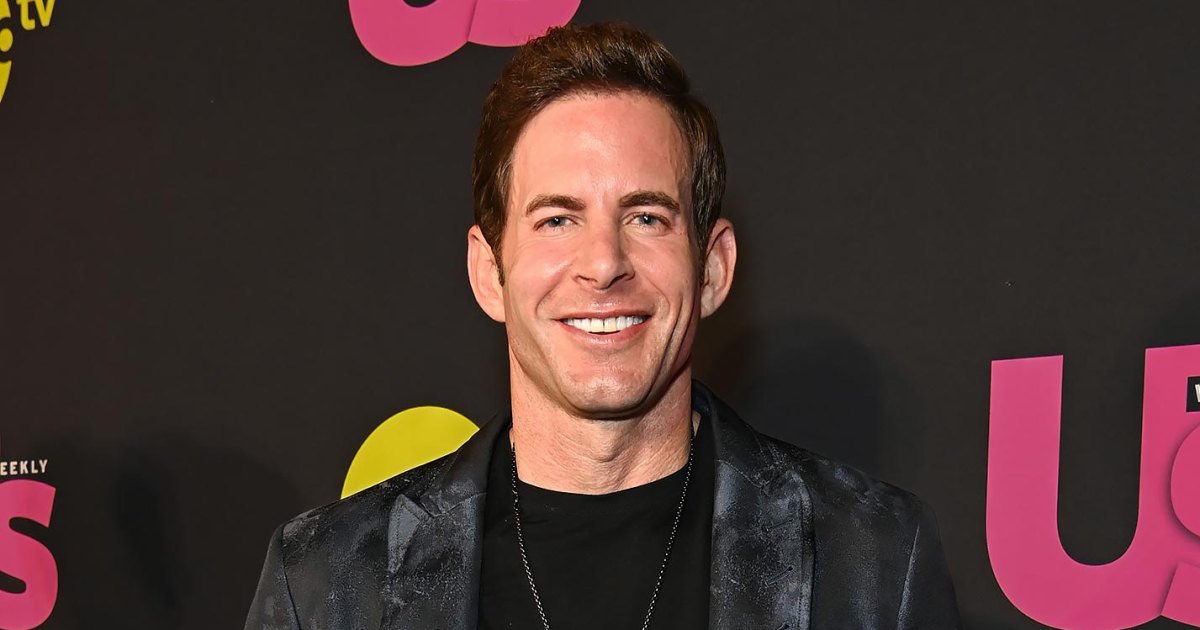

Inside Tarek El Moussa’s Real Estate Empire: How He Nets $675K Monthly

Tarek El Moussa, star of HGTV’s Flip or Flop, has built a real estate empire generating an astonishing $675,000 per month. Through strategic investments, television revenue, and savvy business moves, the 42-year-old investor transformed from a struggling agent to a multimillionaire. His success stems from diversification, branding, and leveraging media exposure—a blueprint for aspiring real estate moguls.

The Foundations of El Moussa’s Wealth

El Moussa’s monthly earnings break down into multiple streams, each contributing to his financial powerhouse:

- Property Flips: His core business, averaging 10-15 flips annually with profits exceeding $200,000 per project.

- Rental Portfolio: Over 150 units generating $150,000+ monthly in passive income.

- TV and Media: HGTV residuals, production deals, and YouTube ad revenue add six figures monthly.

- Education Products: Online courses and mentorship programs contribute $50,000+ monthly.

“Tarek mastered the art of monetizing expertise,” says real estate analyst Mark Liu. “Where most agents stop at commissions, he built verticals that compound returns.” Industry data shows only 3% of agents cross the $1M annual mark—El Moussa’s $8.1M yearly income places him in the top 0.1%.

Strategic Moves That Scaled His Business

El Moussa’s trajectory wasn’t accidental. Key decisions propelled his growth:

Leveraging Television Exposure: After Flip or Flop‘s 2013 debut, he parlayed fame into branded partnerships. His recognizable face now commands premium listing prices—homes he markets sell 18% faster than local averages, per MLS data.

Automating Acquisition: His team uses AI-driven tools to identify undervalued properties. “We analyze 20,000 listings monthly,” El Moussa noted in a recent interview. “Algorithms flag diamonds in the rough before competitors see them.”

Risk Management Tactics

Even during market downturns, El Moussa maintains profitability through:

- Geographic Diversification: Holdings span California, Texas, and Florida, mitigating regional slumps.

- Hybrid Financing: Mixes private money loans with traditional mortgages to preserve liquidity.

- Exit Strategies: Every purchase includes three potential profit paths (rent, flip, or wholesale).

Critics argue his model isn’t replicable for average investors. “Tarek benefits from economies of scale and celebrity status,” remarks financial journalist Naomi Klein. “But his fundamentals—location analysis, value-add improvements—are teachable.”

The Education Arm: Monetizing Knowledge

El Moussa’s Real Estate Agent Jumpstart course exemplifies his ability to scale expertise. Priced at $997, it’s sold to over 8,000 students since 2020. Combined with $2,500/month mastermind groups, this segment rivals his flipping income.

“Education creates perpetual revenue,” explains business coach Derek Johnson. “While flipping requires constant work, courses pay dividends for years with minimal overhead.”

Future Outlook and Industry Impact

With plans to expand into commercial real estate and a new TV series in development, El Moussa shows no signs of slowing. His success highlights broader trends:

- The rise of “personal branding” as a real estate asset

- Technology’s role in leveling the investment playing field

- Hybrid career models blending media and traditional investing

For those inspired by his journey, El Moussa emphasizes fundamentals: “Market knowledge beats market timing. Master your niche, reinvest profits, and build systems before scaling.”

Want to analyze more high-performing real estate strategies? Subscribe to our investor newsletter for weekly breakdowns of top earners’ tactics.

See more Business Focus Insider Team