Nvidia’s Earnings Report: Understanding Infrastructure Spending and DeepSeek Concerns

As Nvidia gears up to reveal its latest earnings report, investors and analysts alike are bracing for insights that could significantly impact the tech industry. With increased infrastructure spending and rising concerns surrounding its artificial intelligence initiative, DeepSeek, this earnings call is poised to be pivotal. In this article, we will explore how these factors could shape investor sentiment and the broader tech landscape in the coming months.

The Impact of Infrastructure Spending on Nvidia’s Earnings

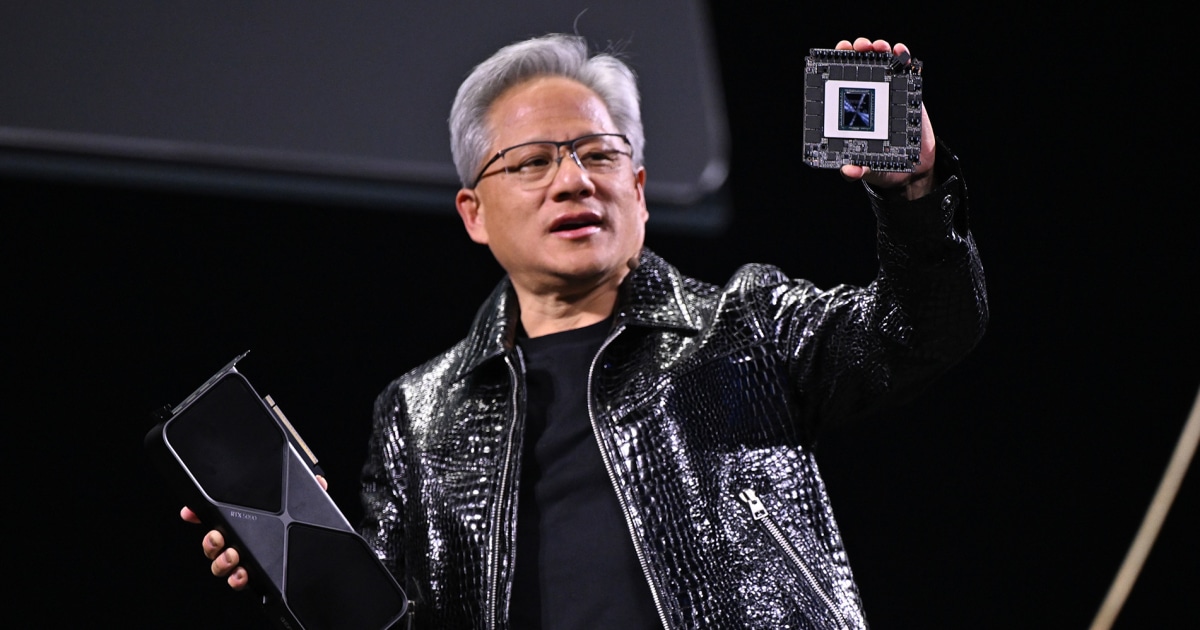

Nvidia has long been a leader in graphics processing units (GPUs) and has increasingly invested in infrastructure to support its expansive growth. The company’s commitment to infrastructure spending has several dimensions:

- Data Centers: Nvidia has been significantly expanding its data center capabilities, crucial for supporting cloud computing and AI workloads. This investment is expected to bolster its revenue as more businesses adopt AI technologies.

- Manufacturing Facilities: To meet the surging demand for chips, Nvidia is investing in manufacturing capabilities, which is essential in the face of global supply chain challenges.

- Research and Development: Increased R&D spending is vital for staying ahead in the tech race, particularly in AI and machine learning, where Nvidia is a key player.

These investments not only enhance Nvidia’s operational capabilities but also signal to investors that the company is positioning itself for long-term growth. Analysts predict that robust infrastructure spending will lead to higher revenues, particularly in the data center segment, which has become a cornerstone of Nvidia’s business model.

DeepSeek: Opportunities and Concerns

While infrastructure spending appears to be a positive aspect of Nvidia’s strategy, concerns surrounding DeepSeek—the company’s AI initiative—have emerged as a potential red flag for investors. DeepSeek aims to leverage AI to improve data processing and analytics, but several factors contribute to the apprehension:

- Market Competition: The AI landscape is becoming increasingly competitive, with tech giants like Google and Microsoft investing heavily in similar technologies. Nvidia must continue to innovate to maintain its edge.

- Regulatory Scrutiny: As AI technologies evolve, they face growing scrutiny from regulators concerned about ethical implications and data privacy. This could lead to increased compliance costs or restrictions on operations.

- Technical Challenges: Developing AI solutions like DeepSeek involves overcoming significant technical hurdles. Any setbacks in the development process could impact Nvidia’s reputation and market position.

Investor Sentiment and Market Reactions

The combination of increased infrastructure spending and the concerns surrounding DeepSeek could create a mixed bag for investor sentiment. On one hand, the market may react positively to Nvidia’s commitment to infrastructure, viewing it as a sign of strength and future growth potential. On the other hand, apprehension regarding DeepSeek could temper enthusiasm, leading to volatility in Nvidia’s stock price.

Here are some factors to consider as investors prepare for Nvidia’s earnings report:

- Historical Performance: Nvidia has consistently delivered strong earnings, often exceeding analyst expectations. If this trend continues, it could bolster confidence among investors.

- Guidance and Projections: Investors will closely scrutinize Nvidia’s guidance for future quarters. Positive projections, especially in the data center segment, could offset concerns about DeepSeek.

- Market Trends: The overall tech market’s performance will also influence investor sentiment. If the sector is thriving, investors may be more forgiving of Nvidia’s challenges with DeepSeek.

Strategies for Investors

In light of these developments, investors should consider several strategies to navigate the upcoming earnings report:

- Diversification: Given the uncertainties surrounding DeepSeek, diversifying investments within the tech sector can mitigate risks associated with Nvidia’s performance.

- Long-Term Perspective: Nvidia’s investments in infrastructure may take time to pay off, so adopting a long-term investment strategy can help weather short-term volatility.

- Stay Informed: Keeping abreast of news related to Nvidia, its competitors, and the broader tech landscape will help investors make informed decisions.

Conclusion: A Critical Juncture for Nvidia

Nvidia’s upcoming earnings report represents a critical moment for the company, highlighting the balance between promising infrastructure investments and the looming concerns over DeepSeek. As the tech landscape continues to evolve, investors must stay vigilant and assess both the opportunities and risks associated with Nvidia’s strategies.

In conclusion, the interplay between infrastructure spending and DeepSeek concerns will likely shape investor sentiment and the tech landscape for months to come. By staying informed and adopting a strategic approach, investors can better navigate this exciting yet uncertain period for Nvidia.

See more Business Focus Insider Team