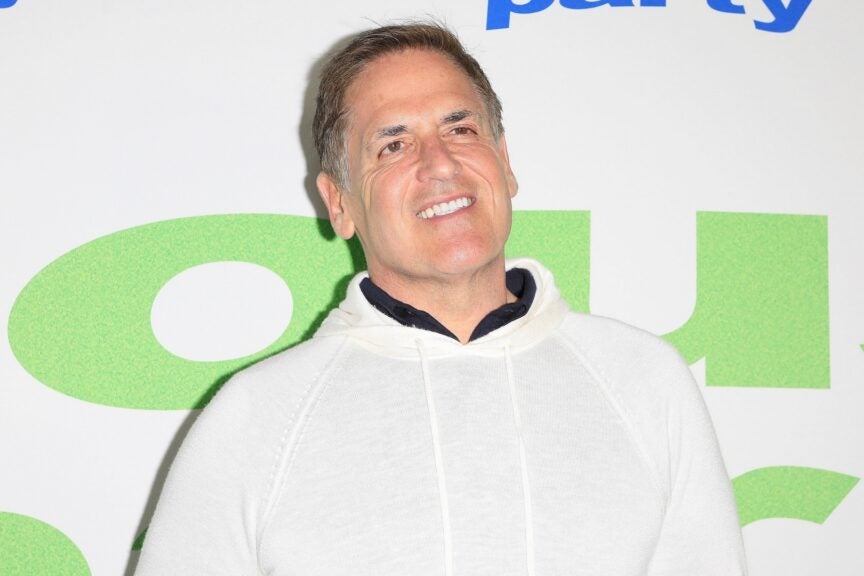

Mark Cuban Challenges Trump’s Tariff Stance Amid Small Business Relief Debate

Billionaire investor Mark Cuban has publicly questioned former President Donald Trump’s approach to small business relief amid ongoing tariff controversies. The exchange, which unfolded during a recent economic policy discussion, highlights growing tensions between corporate interests and Main Street enterprises. Experts warn that unresolved tariff disputes could disproportionately harm smaller businesses already struggling with inflation and supply chain disruptions.

The Clash Over Economic Priorities

Cuban, known for his outspoken views on entrepreneurship, challenged Trump’s deflection of questions regarding targeted relief for small businesses affected by import taxes. “When we’re talking about 30% tariffs on Chinese goods, we’re not just talking about multinational corporations – we’re talking about mom-and-pop shops that can’t absorb those costs,” Cuban stated during a CNBC interview last week.

Recent data from the National Federation of Independent Business (NFIB) underscores Cuban’s concerns:

- 68% of small businesses report significant cost increases due to tariffs

- Only 12% have successfully passed these costs to consumers

- 43% have reduced hiring plans as a result

Trump’s Tariff Policy: Protectionism or Problem?

The former president defended his approach, arguing that tariffs strengthen domestic manufacturing. “We have to protect our workers and our factories,” Trump responded during a rally in Michigan. “The small businesses will benefit when we bring jobs back to America.”

However, economic analysts present a more nuanced picture. Dr. Alicia Reynolds, trade policy expert at the Brookings Institution, notes: “While certain sectors like steel production saw temporary gains, the broader small business ecosystem – particularly retailers and manufacturers relying on imported components – faced severe margin compression.”

The Congressional Budget Office estimates that Trump-era tariffs reduced real GDP by 0.3% annually – a significant impact for businesses operating on thin margins.

Small Business Relief: A Growing Political Flashpoint

The debate occurs as both parties position themselves as champions of small business ahead of the 2024 election. Cuban, a frequent critic of both major parties, has proposed what he calls a “Main Street First” policy framework:

- Tariff exemptions for businesses under $10M in revenue

- Direct cost-offset subsidies for verified tariff impacts

- Enhanced SBA loan programs with preferential rates

Meanwhile, Trump allies argue the focus should remain on broader economic restructuring. “You can’t make an omelet without breaking eggs,” said Sen. Josh Hawley (R-MO). “Temporary pain for small businesses is unfortunate but necessary to rebuild American industrial capacity.”

The Human Cost of Trade Wars

In Dayton, Ohio, hardware store owner Miriam Castillo represents the frontline impact. “We saw our wholesale costs jump 22% on tools and fixtures,” she explains. “We’ve had to cut staff hours just to keep the doors open.” Stories like Castillo’s have become common in industries ranging from automotive repair to specialty food services.

A 2023 Yale study found that tariff-related price increases hit rural businesses 37% harder than urban enterprises due to thinner supplier networks and less pricing power. This geographic disparity has fueled political tensions in key swing states.

What’s Next for Small Business Policy?

As the debate intensifies, several developments loom on the horizon:

- The House Small Business Committee has scheduled hearings on tariff mitigation strategies

- Three bipartisan bills proposing targeted relief are in early committee stages

- The White House is reportedly considering executive actions to ease import costs

Dr. Reynolds suggests the solution may require more nuanced policymaking: “We need mechanisms that protect strategic industries without treating all small businesses as collateral damage. That means smarter tariffs with surgical exemptions, not blanket policies.”

For entrepreneurs like Castillo, the timeline for relief can’t come soon enough. “We don’t have the reserves the big companies do,” she says. “Every month this continues pushes more of us closer to the edge.”

As the 2024 election approaches, the small business vote may hinge on which candidate can articulate – and deliver – a viable path through the tariff thicket. For now, voices like Cuban’s ensure the issue remains in the national spotlight.

Small business owners impacted by tariffs can contact their Congressional representatives through the U.S. House of Representatives website to share their experiences and advocate for policy changes.

See more Business Focus Insider Team