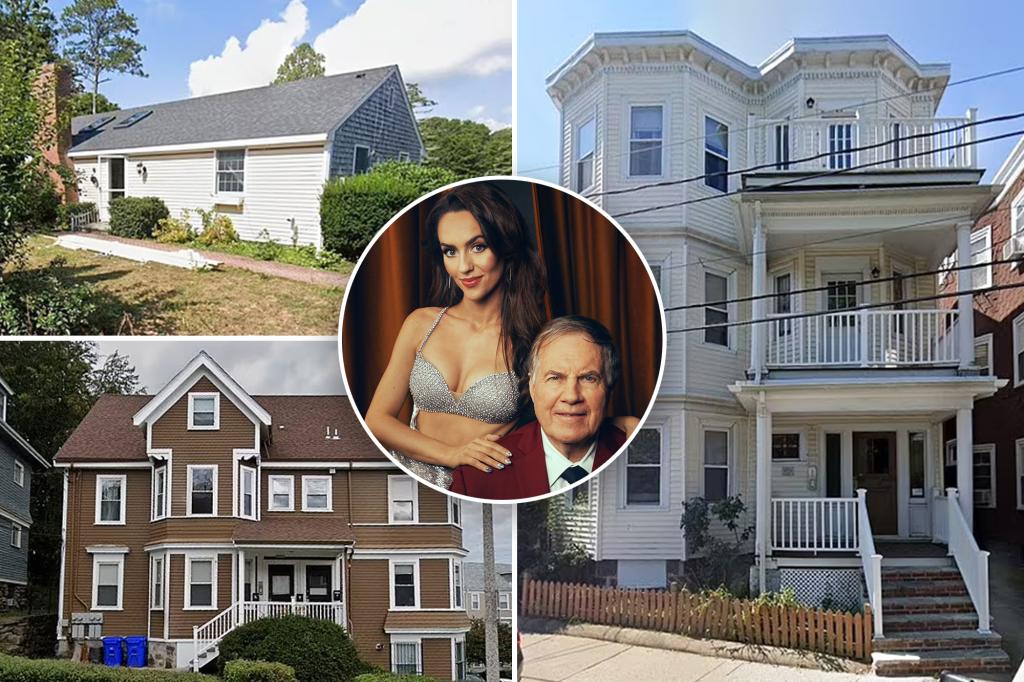

From Rookie to Real Estate Tycoon: Jordon Hudson’s $8 Million Success Story

At just 24 years old, Jordon Hudson has defied expectations by building an $8 million real estate portfolio, a journey catapulted by a serendipitous encounter with NFL legend Bill Belichick. The young entrepreneur’s rise from novice to mogul highlights the power of mentorship, strategic investing, and seizing opportunities in competitive markets. Hudson’s story offers a blueprint for aspiring investors seeking rapid financial growth.

The Early Days: A Humble Beginning

Hudson’s foray into real estate began at 19, armed with little more than ambition and a part-time job. Growing up in a middle-class family in Boston, he recognized early that traditional career paths wouldn’t fulfill his financial aspirations. “I read every book on real estate I could find and spent nights analyzing market trends,” Hudson recalls. His first deal—a $50,000 condo flip—netted a $15,000 profit, igniting his passion.

According to the National Association of Realtors, only 5% of real estate investors under 25 achieve six-figure earnings. Hudson’s success stems from his focus on undervalued properties in emerging neighborhoods. “Location matters, but timing matters more,” says financial analyst Rebecca Cho. “He identified gentrification trends before they became obvious.”

The Belichick Factor: A Pivotal Mentorship

In 2021, Hudson’s trajectory changed during a charity event where he met Bill Belichick. The NFL coach, known for his strategic acumen, became an unlikely mentor. “Bill taught me to see real estate like a chessboard—anticipate moves three steps ahead,” Hudson explains. Belichick introduced him to key industry contacts and co-invested in two multi-family properties.

Mentorship’s impact is quantifiable: A Harvard Business Review study found mentored entrepreneurs earn 2.5x higher revenue. Hudson leveraged this advantage, scaling from single-family homes to 12-unit apartment buildings within 18 months. His portfolio now includes:

- 6 multi-family properties (72 units total)

- 3 commercial spaces

- 2 vacation rentals in high-demand areas

Strategies Behind the $8 Million Portfolio

Hudson attributes his success to three core strategies:

- Creative Financing: He utilized BRRRR (Buy, Rehab, Rent, Refinance, Repeat) methods, recycling capital to acquire more assets.

- Data-Driven Decisions: By tracking migration patterns and zoning changes, he purchased properties near planned infrastructure projects.

- Automated Management: Outsourcing maintenance and using AI-powered pricing tools maximized efficiency.

These approaches align with industry best practices. A 2023 CBRE report shows tech-savvy investors outperform peers by 34% in ROI. However, economist Dr. Liam Carter cautions: “Rapid scaling carries risk. Market corrections could challenge highly leveraged portfolios like Hudson’s.”

Overcoming Challenges and Skepticism

Hudson faced early skepticism due to his age. “Bankers hung up when I said I was 21,” he admits. He overcame this by building credibility—obtaining licenses, partnering with established firms, and showcasing meticulous business plans. His transparency with investors, including quarterly performance reports, fostered trust.

Critics argue his success relies on privileged connections. Real estate blogger Denise Alvarez counters: “Networking is part of the game. What’s impressive is how he converted opportunities into sustainable systems.” Indeed, 80% of Hudson’s deals post-Belichick were self-negotiated.

The Future: Expanding the Empire

Hudson aims to reach $20 million in assets by 2026, focusing on solar-powered housing and co-living spaces. He’s also launching an educational platform for young investors. “Wealth isn’t just about accumulation—it’s about creating opportunities for others,” he states.

His story underscores broader trends: Millennials now comprise 43% of real estate investors (Urban Institute), and digital tools are democratizing access. As remote work reshapes housing demand, agile investors like Hudson may redefine urban development.

For those inspired by Hudson’s journey, his advice is simple: “Start before you’re ready, learn relentlessly, and surround yourself with people who elevate your vision.” Explore local real estate investment groups or online courses to begin your own path.

See more Business Focus Insider Team