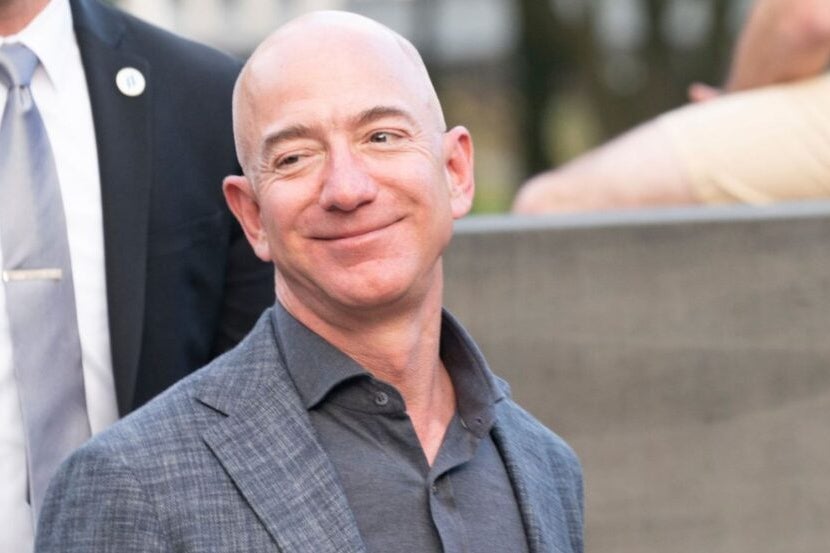

Jeff Bezos, Amazon’s founder and former CEO, plans to sell approximately $5 billion worth of his company stock, according to recent SEC filings. The move, expected to occur within the next nine months, marks one of Bezos’ largest divestments in recent years. While the exact reasons remain undisclosed, analysts speculate this could reflect personal financial planning, philanthropic commitments, or shifting confidence in Amazon’s growth trajectory amid evolving market conditions.

Understanding the Scale of Bezos’ Stock Sale

The planned sale represents roughly 25 million shares, or 2.4% of Bezos’ total Amazon holdings. Even after this transaction, he will retain about 912 million shares worth approximately $175 billion at current valuations. Historical data reveals this isn’t Bezos’ first major sale:

- 2020: Sold $10 billion during pandemic-era market highs

- 2021: Divested $8.8 billion as part of scheduled trading plans

- 2023: Liquidated $4.1 billion before relocating to Miami

“This sale follows a predictable pattern of gradual diversification,” notes financial analyst Margaret Chen of Bernstein Research. “What’s noteworthy is the timing—coming just as Amazon hits all-time highs following its AI infrastructure announcements.”

Potential Motivations Behind the Move

Market observers have proposed several theories about Bezos’ decision:

1. Portfolio Rebalancing: With Amazon stock surging 75% since January 2023, selling allows Bezos to lock in gains and reduce concentration risk. “No financial advisor would recommend having 90% of your net worth in a single stock, even if you founded the company,” explains wealth manager David Parkerson.

2. Blue Origin Funding: Bezos has previously sold Amazon shares to fund his space exploration company, committing $1 billion annually. The current space race with SpaceX may require additional capital.

3. Philanthropic Pledges: Through the Bezos Earth Fund, he’s promised $10 billion toward climate change initiatives by 2030. Recent donations to Hawaiian wildfire relief suggest increased charitable activity.

How Amazon Investors Might Be Affected

While insider sales often trigger short-term volatility, most analysts expect limited long-term impact. Amazon’s average daily trading volume of $12 billion can easily absorb this $5 billion sale spread over months. However, psychological factors may influence market perception:

- Sentiment Shift: Some investors view founder sales as bearish signals

- Valuation Concerns: Amazon currently trades at 40x forward earnings

- Leadership Changes: Andy Jassy’s CEO tenure remains relatively new

“The bigger question isn’t about liquidity,” suggests tech sector analyst Rahul Kapoor, “but whether this indicates Bezos sees fewer growth levers ahead for Amazon compared to his other ventures.”

Historical Precedents in Tech Leadership

Founder stock sales have produced mixed outcomes across Big Tech:

| Executive | Sale Amount | Market Reaction |

|---|---|---|

| Mark Zuckerberg (2021) | $4.4 billion | Meta shares rose 22% that quarter |

| Elon Musk (2022) | $23 billion | Tesla dropped 37% over 6 months |

| Bill Gates (2000-2014) | $38 billion | Microsoft grew steadily |

Amazon’s fundamentals remain strong, with Q1 2024 showing:

- 13% revenue growth year-over-year

- AWS cloud division up 17%

- Advertising revenue surpassing $12 billion

The Broader Implications for Tech Sector

Bezos’ move coincides with several industry trends:

Founder Transitions: Many tech pioneers are reducing operational roles while maintaining influence. Gates, Page, and Dorsey have followed similar paths.

Market Maturation: As cloud computing growth slows from 30% to mid-teens, even dominant players face reinvestment challenges.

Regulatory Pressures: Increased FTC scrutiny may be prompting early-stage diversification among tech billionaires.

“We’re witnessing the third act of the dot-com generation,” observes Stanford business professor Emily Wong. “These founders are reallocating capital from their creation stories to their legacy projects—space, media, philanthropy.”

What Investors Should Watch Next

Key indicators for Amazon’s trajectory include:

- The pace of Bezos’ sales—whether gradual or accelerated

- Any changes in insider buying patterns among other executives

- Q2 earnings report on July 25, particularly AWS performance

- Updates on Amazon’s AI initiatives and grocery expansion

For retail investors, financial advisors generally recommend:

- Avoiding knee-jerk reactions to insider transactions

- Focusing on Amazon’s price-to-cash-flow ratio (currently 15x)

- Monitoring whether institutional investors follow Bezos’ lead

Conclusion: Reading Between the Lines

While $5 billion represents a substantial sum, it’s a calculated move within Bezos’ broader wealth management strategy. The sale likely reflects personal financial considerations rather than diminished faith in Amazon, whose innovation pipeline remains robust. However, it underscores how tech’s founding generation is transitioning from operators to capital allocators—a trend that will reshape investment landscapes.

Investors seeking deeper analysis can access our free webinar on interpreting insider transactions, featuring former SEC regulators and portfolio managers. As always, diversification and long-term perspective remain paramount when navigating such developments.

See more Business Focus Insider Team