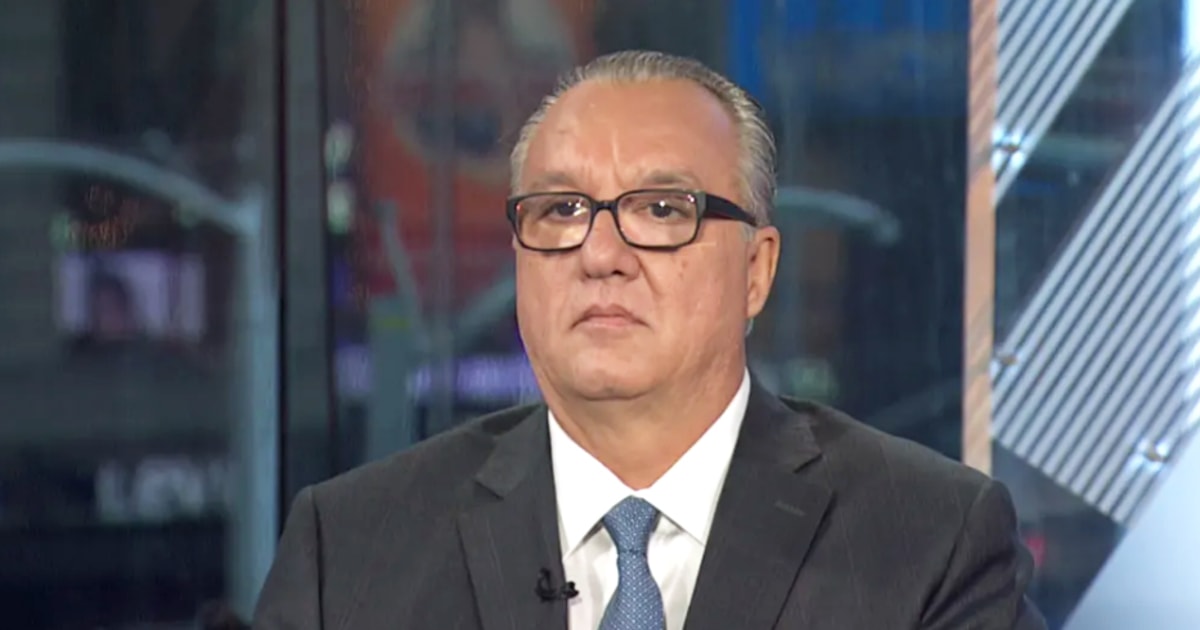

Cleveland-Cliffs CEO Takes Aim at Japan: A Strategic Move Amid U.S. Steel Acquisition Ambitions

In the evolving landscape of the global steel industry, Cleveland-Cliffs CEO, Lourenco Goncalves, has set his sights on Japanese competitors while simultaneously reaffirming the company’s strategic interest in acquiring U.S. Steel. This dual focus not only highlights Cleveland-Cliffs’ ambitions but also signals a potential shift in market dynamics that could reshape the industry as a whole.

The Strategic Landscape of the Steel Industry

As of late 2023, the steel industry is grappling with various challenges, including fluctuating demand, rising raw material costs, and increasing competition from international players. With major steel producers like Japan’s Nippon Steel and JFE Holdings holding significant market shares, Cleveland-Cliffs is positioning itself to increase its footprint both domestically and internationally.

Goncalves has articulated a clear vision for Cleveland-Cliffs, emphasizing the importance of strategic acquisitions to enhance the company’s operational capabilities and market reach. The potential acquisition of U.S. Steel, a historic player in the American steel sector, is a cornerstone of this vision. By targeting U.S. Steel, Cleveland-Cliffs aims to consolidate its resources and expertise, creating a more formidable competitor against both domestic and international rivals.

Cleveland-Cliffs’ Ambitions in Acquiring U.S. Steel

The bid for U.S. Steel is not merely a financial transaction; it reflects a broader strategy to revitalize American steel manufacturing. The acquisition would not only expand Cleveland-Cliffs’ production capacity but also enhance its technological capabilities. This is critical as the industry moves towards more sustainable practices and innovative production methods.

- Increasing Capacity: The acquisition would significantly boost Cleveland-Cliffs’ steel production capabilities, positioning it to meet the growing demand in various sectors, including automotive and construction.

- Enhancing Technology: U.S. Steel’s advanced manufacturing technologies could complement Cleveland-Cliffs’ existing operations, driving efficiency and reducing costs.

- Strengthening Market Position: A successful acquisition would allow Cleveland-Cliffs to establish a more dominant position in the North American steel market.

Challenges in the Acquisition Journey

Despite the potential benefits, the road to acquiring U.S. Steel is fraught with challenges. Regulatory hurdles, market reactions, and stakeholder interests must be navigated carefully. The steel industry is highly regulated, and any acquisition will undergo scrutiny from multiple regulatory bodies to ensure compliance with antitrust laws.

Moreover, the reaction from investors and market analysts will play a crucial role in determining the success of the acquisition. Cleveland-Cliffs must present a compelling case that outlines how this acquisition will create value for shareholders while ensuring operational synergies.

Targeting Japanese Competitors

In addition to its ambitions regarding U.S. Steel, Cleveland-Cliffs is also taking a proactive stance against Japanese steel producers. Japan has long been a leader in the steel industry, known for its technological advancements and high-quality steel products. By aiming at Japan, Cleveland-Cliffs is not only acknowledging the competition but also signaling its intent to innovate and improve its offerings.

Goncalves has emphasized that the company’s strategy will involve enhancing product quality and diversifying its offerings to better compete with Japanese steelmakers. This may include investments in research and development to foster innovation in steel production and processing.

The Importance of Quality and Innovation

To successfully compete with Japanese manufacturers, Cleveland-Cliffs will need to focus on several key areas:

- Product Quality: Enhancing the quality of steel products is paramount. This involves investing in advanced production technologies and processes.

- R&D Investments: Allocating resources to research and development can lead to innovative solutions, allowing Cleveland-Cliffs to offer superior products.

- Customer Engagement: Building strong relationships with customers and understanding their needs can help tailor products that meet market demands.

Global Market Considerations

The global steel market is complex and influenced by various factors, including trade policies, economic growth, and geopolitical tensions. Cleveland-Cliffs must navigate these dynamics carefully, particularly as trade relations between the U.S. and other countries, including Japan, fluctuate.

Additionally, the push for sustainability in industrial practices is reshaping how steel is produced and consumed. Companies worldwide are under pressure to reduce their carbon footprints, and Cleveland-Cliffs is no exception. By focusing on sustainable practices, the company can not only comply with regulations but also enhance its reputation and appeal to environmentally conscious consumers.

The Future of Cleveland-Cliffs

Looking ahead, Cleveland-Cliffs is poised for significant growth, driven by its strategic initiatives and market ambitions. The dual focus on acquiring U.S. Steel and addressing competition from Japan reflects a comprehensive approach to market leadership. By navigating the complexities of the steel industry and investing in innovation, Cleveland-Cliffs can secure a competitive edge.

In conclusion, Cleveland-Cliffs CEO takes aim at Japan while pursuing U.S. Steel acquisition ambitions represents a pivotal moment in the steel industry. As the company seeks to redefine its position in the global market, the outcomes of these strategic moves will not only impact Cleveland-Cliffs but also the broader steel landscape. Stakeholders will be watching closely as the company embarks on this journey, eager to see how it will reshape the future of steel manufacturing.

See more Business Focus Insider Team