As global air travel demand rebounds post-pandemic, China’s aerospace sector faces mounting trade barriers, technological hurdles, and geopolitical tensions. Over the past decade, Chinese manufacturers like COMAC have aimed to rival Boeing and Airbus, but supply chain disruptions, export controls, and certification delays threaten their progress. Analysts warn these challenges could reshape the international aviation market, with implications for airlines, suppliers, and passengers worldwide.

China’s Aerospace Ambitions Meet Reality

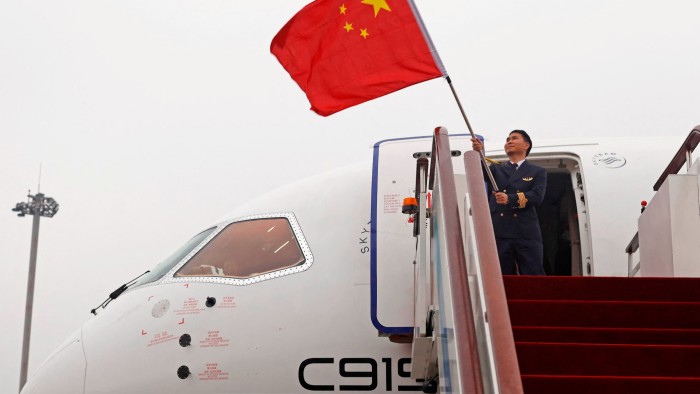

China’s state-backed Commercial Aircraft Corporation of China (COMAC) has invested over $50 billion since 2008 to develop homegrown jets like the C919 narrow-body airliner. Despite securing 1,200 orders—mostly from domestic carriers—the program lags behind schedule. Only six C919s have been delivered since its 2023 commercial debut, compared to Boeing’s 737 production rate of 31 jets monthly.

“The C919 is 60% dependent on Western suppliers for critical systems like engines and avionics,” says Dr. Li Wei, an aerospace economist at Beijing University. “This vulnerability became stark when the U.S. banned GE from transferring LEAP engine technology in 2020.” Although temporary exemptions allowed production to continue, the incident exposed China’s reliance on foreign expertise.

Trade Barriers and Supply Chain Vulnerabilities

The U.S.-China trade war has hit aerospace particularly hard. Key challenges include:

- Export controls: Since 2018, 214 Chinese aerospace entities have been added to the U.S. Entity List, restricting access to semiconductors and composite materials.

- Certification delays: The C919 lacks FAA and EASA approval, limiting it to Chinese routes. European regulators cite “incomplete safety data submission.”

- Localization gaps: Only 40% of the ARJ21 regional jet’s components are domestically sourced, per COMAC’s 2022 annual report.

Meanwhile, Airbus’s new Tianjin assembly line—set to produce 10% of its global A320 output—highlights how Western firms are deepening roots in China while Chinese manufacturers struggle abroad.

Geopolitical Tensions Reshape Market Dynamics

Aviation analyst Mark Ducharme notes: “Aerospace has become a proxy for U.S.-China strategic competition. Washington views COMAC’s subsidies—estimated at $7 billion annually—as market distortion, while Beijing accuses the West of ‘innovation containment’.” The EU’s proposed carbon tariffs on non-EU aircraft could further disadvantage Chinese models with higher fuel consumption.

Emerging markets present mixed opportunities. While Indonesia’s TransNusa recently ordered 30 C919s, Vietnam’s Bamboo Airways canceled its $2 billion commitment, citing “delivery uncertainties.” African and Latin American carriers remain hesitant without Western certifications.

Domestic Market: A Double-Edged Sword

China’s aviation regulator has mandated that domestic airlines source 30% of new fleets from COMAC by 2035. State-backed lessors like ICBC have placed bulk orders, but operational issues persist. In 2023, C919 flights achieved just 78% on-time performance versus the industry’s 88% average, according to FlightGlobal data.

However, the sheer scale of China’s market provides cushioning. With passenger traffic projected to double to 1.6 billion annually by 2042 (IATA data), even a 50% domestic capture would sustain COMAC’s growth. “They’re playing the long game,” says Singapore-based consultant Rachel Zhou. “This isn’t about beating Airbus tomorrow—it’s about having bargaining power in 2050.”

Future Trajectory: Innovation or Isolation?

China’s 14th Five-Year Plan prioritizes aerospace self-sufficiency, with $12 billion earmarked for R&D in areas like:

- Next-gen AECC turbofan engines to replace GE/Safran models

- Advanced avionics partnerships with Russian firms

- Carbon-fiber production to reduce import reliance

Yet decoupling carries risks. “Aviation thrives on global collaboration,” warns former Boeing China president David Wang. “If China builds a parallel system, airlines may face higher costs from incompatible technologies.”

The coming decade will test whether China’s aerospace industry can navigate these trade winds to emerge as a true global competitor—or remain constrained by the very barriers it seeks to overcome. For industry watchers, the key metric will be COMAC’s ability to secure certifications beyond its borders while improving operational reliability.

Want to stay updated on aerospace developments? Subscribe to our newsletter for expert analysis on global aviation trends.

See more Business Focus Insider Team