Boeing’s Turbulent Skies: How Trade Tensions with China Ground Aircraft Orders

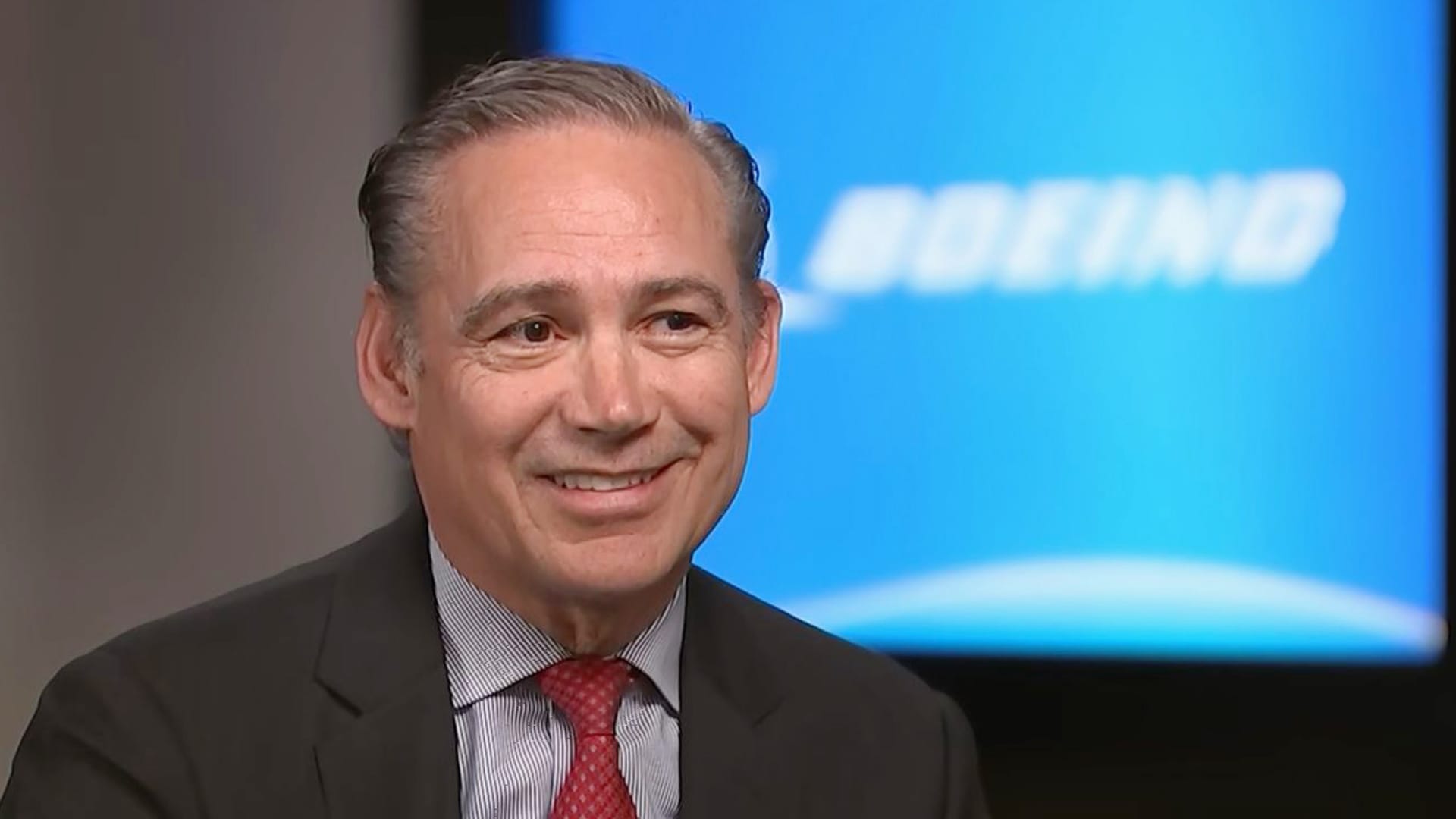

Boeing faces mounting challenges as China halts aircraft purchases amid escalating trade tensions, CEO Dave Calhoun revealed this week. The freeze deals a significant blow to the aerospace giant, which relies on China for nearly 25% of its commercial jet deliveries. This development underscores how geopolitical disputes are reshaping global aviation markets, with ripple effects across supply chains and airline fleets worldwide.

The Breakdown: Boeing’s China Standoff

China, once Boeing’s largest overseas market, hasn’t placed a new order since 2019, with deliveries slowing to a trickle since 2021. The Civil Aviation Administration of China (CAAC) continues to withhold certification for Boeing’s 737 MAX, despite the model’s return to service elsewhere. Industry analysts estimate the impasse has cost Boeing over $30 billion in potential sales.

“This isn’t just about aviation safety anymore—it’s become a geopolitical bargaining chip,” remarked aviation analyst Miranda Cheng of the Asia Society Policy Institute. “Every undelivered 787 Dreamliner represents another pressure point in broader U.S.-China trade negotiations.”

Key impacts include:

- 50+ undelivered 737 MAX jets parked in Boeing facilities

- Postponement of 120+ aircraft orders from Chinese carriers

- 20% decline in Boeing’s Asia-Pacific revenue since 2020

Trade War Fallout Reshapes Aviation Landscape

The aircraft freeze coincides with heightened U.S.-China tensions over semiconductor exports, Taiwan, and intellectual property disputes. Aviation has emerged as an unexpected casualty, given China’s projected need for 8,500 new planes worth $1.5 trillion over the next two decades.

Boeing isn’t the only company affected. Over 300 U.S. aerospace suppliers face reduced orders, with titanium exporter RTI International reporting a 40% drop in China-related revenue. Meanwhile, European rival Airbus has gained market share, securing a $17 billion deal for 150 aircraft during French President Macron’s 2023 Beijing visit.

“The aviation sector has become the canary in the coal mine for U.S.-China trade relations,” noted former U.S. trade negotiator William Chen. “When planes stop flying between nations, it’s a visible symptom of deeper economic fractures.”

Domino Effects on Airlines and Travelers

Chinese carriers face operational challenges as they delay fleet expansions. China Southern Airlines recently leased 30 Airbus A320neos to cover gaps, while Air China postponed retirement of 20 older 737s. These stopgap measures increase maintenance costs and fuel consumption—expenses likely passed to consumers.

Passenger impacts include:

- 5-8% higher domestic airfares in China versus pre-pandemic levels

- Reduced flight frequencies on U.S.-China routes

- Older aircraft with fewer amenities remaining in service longer

Industry group IATA projects China’s aviation growth rate will slow to 4.7% annually through 2025—down from 6.1% pre-tensions—potentially delaying the country’s overtaking of the U.S. as the world’s largest air travel market.

Alternative Strategies Emerge

Boeing is pursuing mitigation strategies, including:

- Accelerating sales to India and Southeast Asia

- Expanding MRO (maintenance, repair, overhaul) partnerships

- Developing sustainable aviation fuel initiatives with Chinese energy firms

The company also seeks to localize more production, recently opening a 737 completion center in Zhoushan. However, these efforts face headwinds as China’s COMAC advances its C919 narrowbody—a direct 737 competitor that secured 1,200 orders, mostly from Chinese carriers.

“Boeing must walk a tightrope,” explained supply chain expert Dr. Alicia Torres. “They need to demonstrate commitment to China’s aviation ecosystem without transferring too much technology that could benefit COMAC long-term.”

What’s Next for Global Aviation?

The standoff’s resolution likely hinges on broader trade negotiations. While Boeing secured a symbolic 50-plane commitment during the 2023 APEC summit, concrete orders remain elusive. The company now forecasts China won’t resume normal purchasing patterns until 2025 at earliest.

Potential scenarios include:

- Breakthrough: MAX recertification and bulk orders if trade tensions ease

- Status Quo: Continued Airbus dominance and COMAC growth

- Escalation: Chinese tariffs on Boeing aircraft or components

As Boeing navigates these turbulent skies, the aviation industry serves as a stark reminder of how geopolitical winds can ground even the most essential economic exchanges. For travelers, airlines, and manufacturers alike, clear air may remain out of reach until Washington and Beijing find common runway.

Want to track how trade policies impact your industry? Subscribe to our weekly geopolitical risk analysis newsletter for expert insights.

See more Business Focus Insider Team