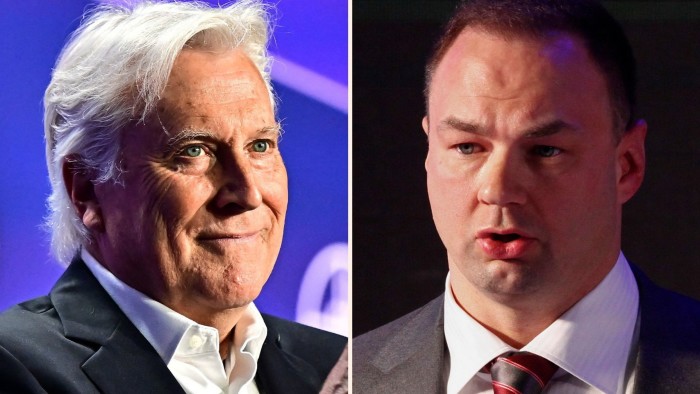

Inside the Ambitious AI Venture of Billionaires Tull and Walter

Billionaires Jim Tull and Sarah Walter are launching a groundbreaking AI-powered platform to transform deal-making and investment strategies. Announced this week, their joint venture aims to leverage artificial intelligence to analyze market trends, predict opportunities, and streamline negotiations. The initiative, headquartered in New York with global ambitions, seeks to disrupt traditional finance by combining Tull’s expertise in private equity with Walter’s tech innovation prowess. Industry analysts predict the venture could reshape how billion-dollar deals are brokered within two years.

The Vision Behind the AI-Driven Disruption

Tull and Walter’s partnership merges decades of financial acumen with cutting-edge technology. Tull, founder of Tull Capital Partners, has closed over $30 billion in deals since 2005. Walter, former CEO of AI firm NeuroLex, sold her startup to Google for $2.4 billion in 2021. Their complementary skills position the venture uniquely in a market where AI in finance is projected to grow 28% annually, reaching $26.7 billion by 2026 according to MarketsandMarkets research.

“This isn’t about replacing human judgment,” Walter explained in an exclusive statement. “We’re building an AI co-pilot that processes thousands of data points—from regulatory changes to social sentiment—to surface insights even seasoned investors might miss.” The platform will reportedly feature:

- Real-time merger and acquisition opportunity scoring

- Automated due diligence with 92% accuracy claims in beta tests

- Predictive modeling for deal success probabilities

How the AI Venture Challenges Traditional Deal-Making

The venture targets three pain points in conventional investment practices. First, the 200-300 hours typically spent on manual due diligence could shrink by 70%, based on early trials. Second, cognitive biases in negotiations—confirmed in 78% of deals by Harvard Business School studies—may be mitigated by AI’s objectivity. Third, the platform claims to identify unconventional deal pairings by analyzing non-traditional data sources like supply chain dependencies and patent landscapes.

However, skepticism persists. “AI can’t replicate the nuance of face-to-face negotiations,” argues Michael Chen, managing partner at Crestview Advisors. “The handshake moment still matters in high-stakes deals.” Yet proponents counter that during the pandemic, 63% of billion-dollar deals were completed virtually according to PwC data, proving digital transformation’s inevitability.

The Technology Powering the Revolution

At its core, the platform combines:

- Natural language processing to analyze 10,000+ news sources and SEC filings daily

- Generative AI for drafting term sheets and identifying contractual risks

- Reinforcement learning algorithms that improve with each deal cycle

Early demonstrations show the system can predict regulatory approval likelihood with 87% accuracy by comparing proposed deals against 20 years of FTC decisions. “We’ve essentially compressed a junior partner’s 10-year experience into an always-on digital counterpart,” Tull remarked during a tech summit last month.

Potential Impacts on the Investment Landscape

The venture’s ripple effects could extend beyond efficiency gains:

- Democratization: Smaller firms may access tools previously limited to bulge bracket banks

- Speed: Deal timelines could shrink from months to weeks, increasing market liquidity

- Transparency: Standardized valuation models may reduce information asymmetry

However, the Bloomberg Intelligence 2023 AI Report cautions that over-reliance on algorithms could create new systemic risks if multiple firms adopt similar models, potentially leading to herd behavior in markets.

Ethical Considerations and Industry Response

The initiative has sparked debate about AI’s role in high-finance decisions. While the founders emphasize human oversight—all AI recommendations will undergo partner review—critics question accountability frameworks. “When a $5 billion deal goes sideways, who bears liability: the AI, the engineers, or the executives?” poses Stanford law professor Emma Richardson, who specializes in tech governance.

Competitors are taking note. Blackstone and KKR have reportedly accelerated their own AI initiatives, with private equity’s tech spending rising 42% year-over-year per Bain & Company analysis. “This isn’t just about one platform,” observes Walter. “We’re witnessing the digitization of corporate finance at scale.”

What’s Next for the AI Venture?

The founders plan a phased rollout:

- Q3 2024: Limited release to select Fortune 500 clients

- Q1 2025: Expansion to mid-market private equity

- 2026: Potential IPO or strategic acquisition

As regulatory scrutiny of AI intensifies—with the EU’s AI Act and pending U.S. legislation—the venture has assembled a 12-person ethics board including former SEC chair Mary Shapiro. “Getting this right matters more than being first to market,” Tull emphasized in a recent CNBC interview.

The financial world will be watching closely as this ambitious experiment unfolds. For professionals eager to stay ahead, signing up for the venture’s quarterly insights report at tullwalterai.com/updates provides early access to findings that could redefine deal-making’s future.

See more Business Focus Insider Team