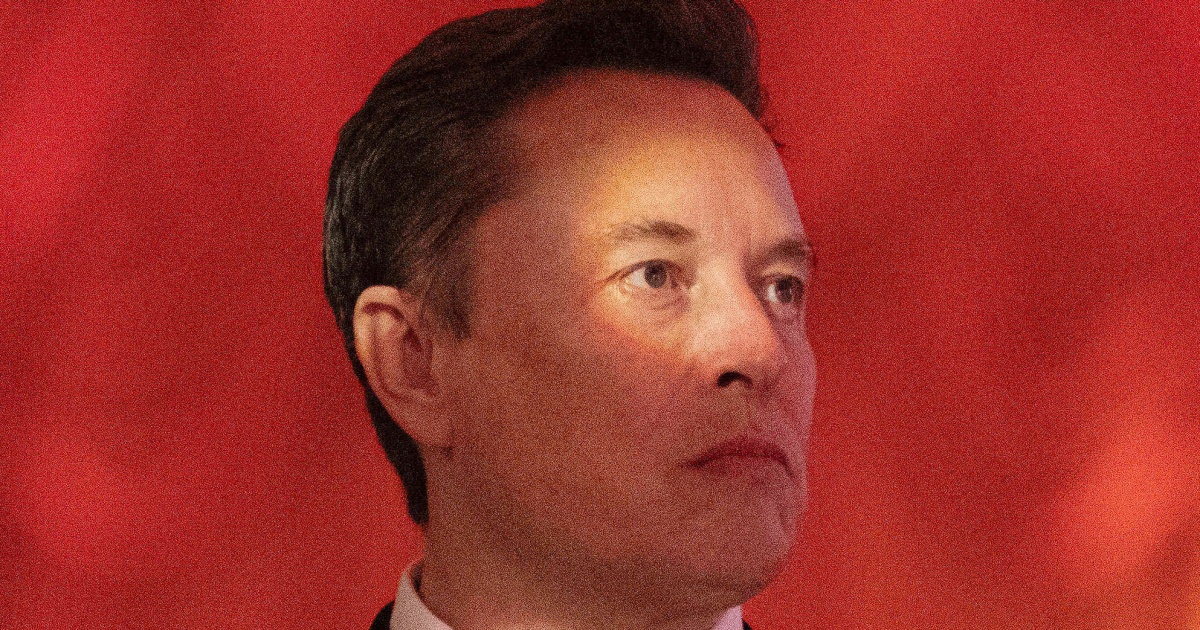

Elon Musk’s $56 Billion Pay Package: A Legal Setback and Its Implications for Tesla’s Future

Elon Musk, the visionary entrepreneur behind Tesla and SpaceX, recently found himself at the center of a high-profile legal battle involving his controversial $56 billion compensation package. This pay package, awarded to Musk in 2018, was structured around ambitious performance-based milestones, with the intention of aligning Musk’s personal wealth with the long-term success of Tesla. However, in a stunning reversal, Musk’s attempt to reinstate the package has been thwarted by a court ruling, raising questions about the broader implications for corporate governance, executive compensation, and the future trajectory of Tesla itself.

The Controversial $56 Billion Pay Package

The package in question was one of the largest executive pay deals in corporate history. In 2018, Tesla’s board approved a pay structure for Musk that did not offer him a traditional salary but instead tied his compensation to the achievement of a series of performance milestones. The package was designed to reward Musk only if Tesla reached specific operational and financial goals, such as increasing the company’s market value and production capacity. The idea was that Musk would benefit financially only if Tesla thrived, aligning his incentives with the company’s long-term growth.

The 2018 compensation plan was met with both praise and criticism. Supporters argued that it incentivized Musk to keep pushing the boundaries of innovation at Tesla while ensuring that shareholders would benefit from his success. Critics, however, questioned whether the package was excessively generous, given that it could lead to Musk receiving billions even as Tesla faced significant financial and operational challenges.

The Legal Challenge: Musk’s Bid for Reinstatement

Fast forward to 2024, and Musk’s battle to reinstate the $56 billion package has become the subject of a legal dispute. The crux of the issue lies in whether Musk met the criteria set out in the original performance plan. While Tesla has made significant progress under Musk’s leadership—expanding into international markets, increasing production capacity, and driving technological innovation—there have been concerns regarding whether all the stipulated performance milestones were fully achieved in the manner intended.

The legal battle began when shareholders, led by the Tesla Investor Group, challenged the compensation package, arguing that the board had effectively allowed Musk to claim payments even when some of the key performance metrics were either not fully realized or reached with questionable timing. Specifically, critics pointed to Musk’s involvement in Tesla’s stock price volatility and the ethical concerns surrounding some of his leadership decisions. In response, Musk and Tesla’s board argued that the metrics were indeed met, and the payments were justified based on the company’s extraordinary growth under Musk’s leadership.

The Court’s Decision

In a major ruling, the court sided with the shareholders, declaring that the pay package was, in fact, not legally enforceable in its original form. The decision was based on the argument that the structure of the compensation package violated principles of fairness and corporate governance, particularly in terms of its level of executive control over performance targets. The court found that Musk had significant influence over certain operational decisions that affected the performance criteria, which, according to legal experts, breached the spirit of objective performance measurement.

As a result, the $56 billion compensation plan was effectively nullified, leaving Musk and Tesla with a legal headache that could have far-reaching consequences. Musk’s legal team has indicated that they will appeal the decision, arguing that the pay package was fully in line with both Tesla’s goals and corporate law. The outcome of the appeal, if it proceeds, could set important precedents for future cases related to executive compensation and shareholder rights.

The Broader Implications of the Ruling

The legal ruling represents more than just a loss for Musk—it also raises several key issues about corporate governance, executive compensation, and shareholder activism in the modern age. Below, we explore the broader implications of the court’s decision.

1. Executive Pay and Corporate Governance

The case underscores growing concerns over the fairness and transparency of executive pay packages in publicly traded companies. While performance-based compensation is a common practice, the challenge lies in ensuring that these packages are structured in ways that are not only beneficial to executives but also aligned with the long-term interests of shareholders and other stakeholders. In this case, the court highlighted concerns about Musk’s disproportionate influence over the performance targets, calling into question the objectivity of such pay structures.

- Transparency: The ruling emphasizes the need for greater transparency in how companies design and evaluate performance targets for their executives.

- Shareholder Involvement: It also raises the question of how much say shareholders should have in approving executive compensation plans, particularly when such packages could have a substantial impact on company performance and financial stability.

The Tesla case is a striking example of the growing influence of shareholder activism in corporate decision-making. Investors are increasingly holding companies and their executives accountable for both financial performance and ethical governance. Shareholders have become more vocal about executive pay, pushing for compensation packages that are not only performance-based but also equitable and transparent.

In the Tesla case, the shareholder group that challenged Musk’s pay package represents a broader trend of investors advocating for more responsible corporate governance. This may signal a shift in how other tech companies, especially those led by powerful and influential figures like Musk, structure their executive compensation packages in the future.

3. Implications for Tesla’s Future

Beyond the legal ramifications, this case could have significant long-term implications for Tesla itself. While the ruling may not directly affect the company’s day-to-day operations, it could influence investor confidence in Tesla’s leadership and governance practices. Tesla’s ability to attract top talent in the future may also be impacted, particularly if the company faces more scrutiny over its executive compensation policies.

- Investor Sentiment: If investors perceive that Tesla’s governance structure is not as robust as it should be, it could affect stock prices and the company’s overall reputation.

- Leadership Continuity: Musk’s ability to lead the company could also be questioned if legal challenges continue to erode public trust in the company’s governance.

The Future of Performance-Based Compensation

The ruling in Musk’s case may also set a broader precedent for how performance-based compensation is structured in the future. While many companies use similar pay models, this case could prompt changes in how such packages are designed, with a greater focus on independent oversight and fairness in the setting of performance milestones.

As companies continue to experiment with compensation packages that tie executives’ pay to long-term success, it will be crucial to strike a balance between incentivizing growth and ensuring that these packages are structured in ways that are ethically sound and legally enforceable. The Tesla case highlights the risks associated with tying executive compensation to subjective or potentially biased performance targets.

Conclusion: A Changing Landscape for Executive Compensation

The legal defeat for Elon Musk is a significant moment in the ongoing debate over executive compensation and corporate governance. While Musk’s compensation package was designed to align his financial incentives with the long-term success of Tesla, the court’s decision serves as a reminder that such pay deals must be carefully crafted to ensure fairness and transparency. The case also highlights the growing power of shareholders and their increasing role in shaping corporate policies.

As the legal battle continues, Musk’s future at Tesla remains a topic of interest. However, the broader lesson may be that the future of executive compensation will likely involve more scrutiny, greater shareholder involvement, and a more cautious approach to aligning performance targets with executive pay. How Tesla navigates these challenges will be crucial to its long-term success and the continued legacy of its ambitious CEO.

For more insights on corporate governance and executive pay, visit this detailed analysis.

For the latest updates on the ongoing legal case, follow CNBC.

See more Business Focus Insider Team