Introduction: ASML’s Resilient Stock Amid Legal Controversy

In recent weeks, ASML Holding, a global leader in semiconductor manufacturing equipment, has found itself in the midst of a complex legal storm. Despite significant developments surrounding allegations of intellectual property theft, the company’s stock has shown remarkable resilience in premarket trading. This has left many investors, analysts, and industry observers questioning what lies ahead for the semiconductor giant.

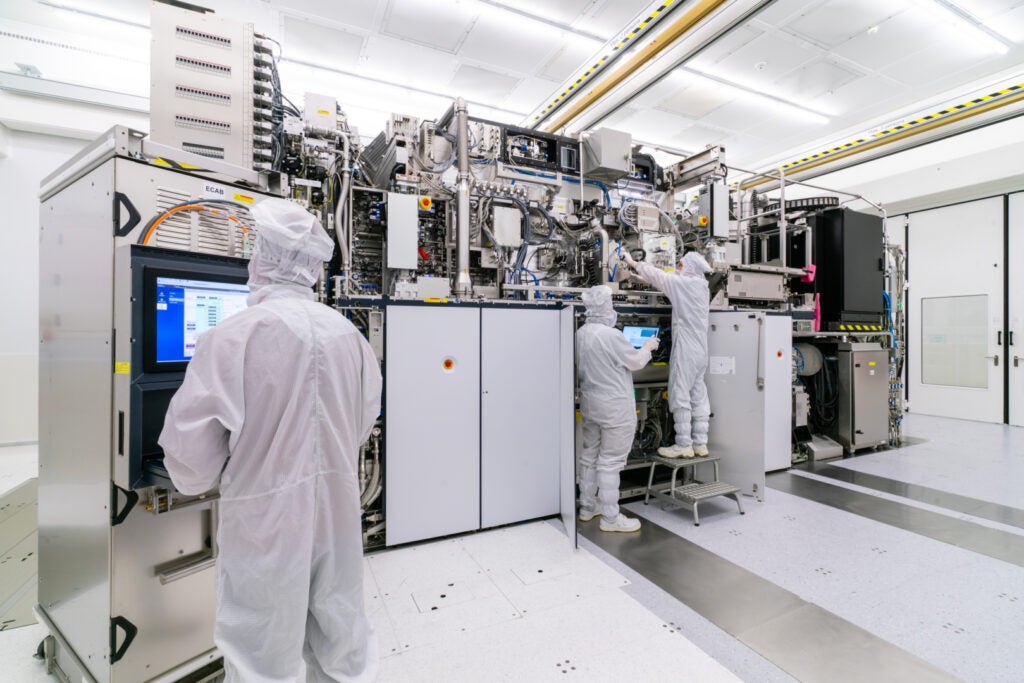

On one hand, ASML’s core technologies are seen as pivotal to the semiconductor industry’s growth, particularly with its cutting-edge extreme ultraviolet (EUV) lithography machines, which play a critical role in the production of next-generation chips. On the other, a recent legal ruling in the Netherlands has cast a shadow over its future. In this article, we will explore the factors driving ASML’s stock performance, the legal challenges the company faces, and what this means for the broader semiconductor market.

Legal Challenges: Allegations of Military-Grade IP Theft

At the heart of ASML’s current predicament is a Dutch court’s decision to detain a suspect linked to military-grade intellectual property theft until February. The suspect is accused of attempting to steal sensitive technology related to ASML’s EUV machines, which are crucial for the production of the most advanced microchips. These chips are used in a variety of high-tech applications, including smartphones, computers, and increasingly in military systems.

The alleged theft of ASML’s intellectual property (IP) is a serious matter, as the company’s proprietary technology is considered one of the most advanced in the world. EUV lithography machines are used to etch incredibly small circuits onto silicon wafers, allowing semiconductor manufacturers to produce chips with ever-smaller features. The theft of such technology could undermine ASML’s competitive edge and potentially enable rival companies to catch up in the race for cutting-edge semiconductor fabrication.

Implications for ASML’s Business Model

ASML’s business model is built on the continuous development of specialized, high-value equipment for the semiconductor industry. The company has enjoyed an almost monopoly-like position in the market for advanced photolithography tools, particularly EUV machines, with no direct competition currently capable of replicating its technology.

- High Barriers to Entry: The development of EUV lithography requires enormous investment in R&D and engineering expertise. ASML has invested billions of euros into developing these machines, a process that spans decades.

- Monopoly Status: Due to its technological edge, ASML is the sole provider of EUV machines, a critical piece of equipment for semiconductor manufacturers like TSMC, Samsung, and Intel.

- IP Protection: With such a valuable position in the market, ASML takes extensive measures to protect its intellectual property, which makes any potential theft especially damaging.

If the alleged theft is confirmed, it could not only damage ASML’s reputation but also harm its future revenue streams. Losing its competitive advantage could open the door for competitors to step in, although the high technical barriers to replication make this unlikely in the short term.

ASML’s Stock Performance Amid the Legal Saga

Despite the mounting legal pressures, ASML’s stock has shown resilience. In premarket trading following the news of the legal detention, shares of the company saw a modest increase. This is a curious development given the potential implications of the case. So, why has the stock not faced a significant downturn?

Investor Confidence and ASML’s Strong Fundamentals

There are a few reasons why investors have not been overly reactive to the legal challenges faced by ASML. First and foremost, the company’s strong financial performance and market position continue to drive investor confidence. ASML reported impressive earnings in its most recent quarterly results, highlighting robust demand for its EUV machines, particularly from leading chipmakers who are ramping up production of advanced nodes.

Moreover, the global semiconductor industry is experiencing a major supply shortage, and ASML’s equipment is critical to meeting the demand for more advanced chips. This ongoing demand for semiconductor manufacturing equipment acts as a buffer against any short-term negative sentiment caused by the legal situation. Investors may believe that the underlying growth story for ASML remains intact, regardless of the legal turmoil.

Broader Semiconductor Industry Implications

The legal situation surrounding ASML could have ripple effects across the semiconductor ecosystem. If the theft of ASML’s intellectual property is part of a larger, coordinated effort to undermine the company’s market dominance, it could signal a shift in how the semiconductor industry operates. However, this is still speculative at this point.

- Supply Chain Disruptions: If ASML’s ability to manufacture and deliver EUV machines is hindered, it could disrupt the supply chains of major semiconductor players who rely on its equipment.

- Geopolitical Concerns: The theft of military-grade IP points to larger geopolitical tensions, particularly between the U.S., China, and Europe. ASML, being a key supplier of technology to the West, could become a focal point in international trade disputes.

- Industry Competition: While ASML holds a dominant market share, companies in China and South Korea are investing heavily in developing their own lithography technologies. Any significant leak of ASML’s technology could accelerate these efforts.

The broader implications of this legal case could also attract the attention of regulators and policymakers. Given the strategic importance of semiconductor manufacturing, governments around the world may take a more active role in ensuring that companies like ASML are protected from IP theft and foreign espionage.

Looking Ahead: What’s Next for ASML?

While the legal troubles facing ASML are serious, the company’s future remains uncertain. Several key factors will determine how ASML navigates these challenges:

- Legal Outcome: The resolution of the current case will be pivotal in shaping ASML’s long-term strategy. If the company can successfully protect its intellectual property and hold perpetrators accountable, its position in the market may strengthen.

- Technological Advancements: ASML’s ability to continue innovating and improving its EUV technology will be crucial. Even amid legal concerns, ASML’s reputation as the leader in photolithography remains intact.

- Market Dynamics: The global semiconductor market is expected to grow rapidly in the coming years. ASML’s future success will depend on its ability to meet the increasing demand for advanced chips.

Investors will also be watching the company’s ability to manage its relationships with key customers, especially in light of potential geopolitical tensions. Strong collaborations with industry leaders, such as TSMC and Samsung, will help solidify ASML’s position as the dominant force in semiconductor manufacturing.

ASML’s stock has proven to be surprisingly resilient despite the legal challenges it faces. While the theft of military-grade intellectual property could have far-reaching consequences, it is important to consider the company’s strong fundamentals, technological leadership, and market position. With the global semiconductor industry still in high demand, ASML’s long-term outlook remains positive, though it must navigate the complex legal and geopolitical landscape.

For investors, the current situation presents both risks and opportunities. While the short-term volatility may create some uncertainty, ASML’s role in the semiconductor ecosystem is unlikely to change in the immediate future. As the case unfolds, the market will be closely watching how ASML responds to these challenges and whether it can maintain its leadership position in the rapidly evolving tech industry.

For more insights into the semiconductor industry and the latest developments at ASML, click here.

For information on the broader legal and geopolitical context, visit BBC News.

See more Business Focus Insider Team